Apple: AI Strategy To Help Fight DOJ, Kickstart Growth (NASDAQ:AAPL) – Technologist

Justin Sullivan

Investment Thesis

In my opinion, Apple (NASDAQ:AAPL) has had a rough patch. In recent months, the iPhone maker has taken a hit partly as a result of the iPhone giant smartphone sales in China dropping 24% year over year, while sales from one of their competitors, Huawei grew by 64% indicating market saturation and potentially plateauing demand for one of the company’s flagship products.

Elsewhere, in Europe, the company is facing regulatory action on their App store, forcing the company to open up their tech products to direct web downloads for apps, allowing consumers and app providers to bypass the App store and the up to 30% revenue cut Apple gets from app store sales. This disrupts one of Apple’s most lucrative divisions. In the US, the US Department of Justice sued Apple last week, claiming they are a monopoly in some of its practices. Ouch.

However, as Apple has been at multiple “make or break” junctures in its lifetime, and has prevailed each time before. I believe this time will be no different, setting up what could be a powerful buying opportunity.

In my opinion, the technology giant could be in for a super cycle based on their expected integration of advanced AI into their product lineup. This integration, I believe, will actually help the company fight new regulatory pushes both in the United States and Europe and help counter iPhone sale issues in China.

Using technology such as through partnerships with major LLM makers such as Google (GOOGL) and Baidu (BIDU), and the expectation of a major upgrade with iOS 18, Apple positions themselves to accelerate market share and foster growth. These advancements may lead Apple to see a larger upgrade cycle, resembling a “super cycle.”

As with any thesis, it’s not clean cut. The company faces antitrust challenges with the DOJ in the US and regulatory action in the EU. Despite this, I remain bullish. I think the company continues to be a strong market leader in the smartphone industry and I expect them to continue to lead in the future. I think the stock continues to be a strong buy.

Here’s Why Apple Needs Coverage Now

Historically, Apple moves in silence. What I mean by this is that they don’t seem to boast about their early stage technological advancements. Considering how fast-paced and influential the AI sector is, it is crucial that any possible advancements are known to investors. The release of Chat-GPT woke up the players in the tech industry; everyone has been racing to become the leading figure in AI. Considering Apple’s stronghold in the iPhone and computer market, it’s been suspicious that they have not publicly joined in on this race. However, this is also consistent with what Tim Cook, Apple’s CEO said on their last call:

Our MO, if you will, has always been to do work and then talk about work and not to get out in front of ourselves. -FY 2024 Q1 Call.

Since my last report last December on Apple, the stock is down 12.01% while the market is up 10.51%. I believe this is largely due to concerns I mentioned in my investment thesis section around slowing demand in China and regulatory actions in the US & Europe.

Background

In 2011 Apple launched Siri in their iPhone 4S, creating a “supercycle” that significantly boosted sales and consumer interest. This was one of Apple’s first integrations of AI into their iPhones.

Since 2011, Siri has helped users through voice recognition and acted as a virtual assistant. The user-friendly interface and capabilities resulted in wide consumer adoption, driving iPhone sales during the initial launch period. Outside of Siri, Apple has made further efforts to develop their AI services, as they have bought 21 AI startups since the beginning of 2017, which is more than many of their competitors.

However, Apple’s current position is critical. The competitive Chinese market has changed: in early 2024, research came out showing that Apple was selling 24% less iPhones in mainland China compared to this time last year. This decline is part of a decreasing revenue trend, with a potential for an even greater decrease towards the end of FY 2024 Q2 in China. The reasoning for this decline may be the perception among Chinese consumers that Apple’s AI offerings fall short to competitors. One of Apple’s biggest competitors in the Chinese market, Huawei, has seen sales grow by 64%. These local companies provide advanced AI features, competitive pricing, and services specific to local preferences.

In essence, Apple needs to innovate. I think their push into AI will do just that.

FY 2024 Q1 Report Provides Clues

During Apple’s FY 2024 Q1 report from February, investors’ attention was on their integration of artificial intelligence (“AI”) across their product lineup. Apple’s recent release of iOS 17 includes new features driven by AI technology. Some of these features include, Personal Voice and Live Voicemail, along with lifesaving applications, such as fall detection, crash detection, and ECG monitoring on the Apple Watch.

As of this earnings report, Apple emphasized their current base of over 2.2 billion active devices, possessing a solid foundation for expansion. In my opinion, most of these devices could eventually be upgraded due to the AI catalyst (and the fact that AI will bring about new features that make consumers interested). I talk more about what I expect from the upgrade cycle in the valuation section, but I think even if a small portion of this active devices base upgrades the benefits could be immense for Apple’s earnings.

Keeping all of this in perspective, by the way, Apple isn’t currently in a tough spot with their positioning in the global smartphone market. Apple actually had the top spot for smartphone market share in 2023 globally (by brand). They even overtook their arch rival Samsung by units sold. I think this is an excellent place to be going into a potential super cycle upgrade.

AI In The iPhone Could be Big

As mentioned above, the integration and advancement of AI in Apple’s devices is a core focus of the company, one of these devices being the iPhone.

This type of technology has the potential to make the iPhone a more intelligent and proactive assistant through features such as seamless voice recognition, predictive text input, smart task automation, and context-aware suggestions. Apple’s own AI model Ajax could improve already implemented technologies such as Siri, by making it more conversational and contextually aware, similar to ChatGPT. Other potential AI features could include auto-summarizing and auto-complete in core apps like Pages and Keynote. Reports show that Apple is also working on a new version of Xcode and other development tools that build in AI for code completion, which would improve the quality of third-party apps on the iPhone.

The advancements of chatbots, personalized app experiences, and improved hardware performance, are powered by deep learning algorithms. This technology aims to achieve more intuitive and personalized services, tailored to individual preferences and behaviors. However, and I think this is key for Apple, the technology giant is also reported to be leveraging LLMs made by competitors like Google, OpenAI or Baidu (BIDU) in China.

I think this strategy is genius. Apple knows that being a leader in the LLM space is difficult and requires a ton of infrastructure buildout. Much like how Google became the default search provider on Safari, I expect a LLM from one of these companies to be the default LLM on devices in the US and Europe, and Baidu’s Ernie to be the default LLM in China.

That’s not to say that Apple themselves is giving up on AI. Like I said, they are still working on their own model, called Ajax. This model, however, will power more local, on device requests that don’t require an internet connection.

The anticipated release of these new AI models is suspected to come at the Worldwide Developers Conference (WWDC) in June. In order to maintain their competitiveness against tech rivals, Apple’s timeline for deploying new AI models like Ajax is supposedly aligning with the launch of upcoming iPhone iterations. This event is typically when Apple unveils their upcoming operating systems and software upgrades.

As of when I am writing this piece, Apple just announced their WWDC conference for June 10th.

AI on the Mac could be huge

The iPhone isn’t the only device receiving the integration of advanced AI, the Mac may be too. Apple has already been making significant strides in integrating AI into their Mac devices. The new 13- and 15-inch MacBook Air, powered by the M3 chip, is currently named the “world’s best consumer laptop for AI” and this is before Apple makes any dedicated AI hardware changes. The M3 chip, constructed from industry-leading 3-nanometer technology, has a faster and more efficient 16-core Neural Engine, along with the CPU and GPU having accelerators to improve on-device machine learning. This makes the MacBook Air an excellent platform for AI, offering power-efficient performance and portability.

Other companies have begun integrating advanced AI technology into their devices, such as Microsoft’s AI initiatives in Windows. Microsoft recently introduced a new Copilot key to Windows 11 PCs. This key, when pressed, invokes the Copilot in Windows experience, making it seamless to engage Copilot in day-to-day tasks. Apple’s use of a similar framework with an AI specific key could allow them to construct a similar mechanism.

The integration of AI technology is a significant contributor to Apple’s future but they also may be opening up opportunities to sell their own AI technologies. Apple has been developing its own generative AI for years. It’s expected that Apple will launch a new software development tool that will use generative artificial intelligence to help bring automations coding work.

Future Outlook In China

The future outlook for Apple, particularly in the Chinese market, heavily relies on the anticipated AI enhancements in iOS 18. These rumored features aim to revitalize iPhone sales, as Apple aims to grow its AI capabilities to recapture its popularity amidst the competitive dynamics of China’s smartphone market.

In order to counteract the current decline in sales and revenue shrinkage in China, Apple will need to increase their investment in AI research and development. Localizing AI features, such as adapting Siri to align more closely with Chinese guidelines for AI model deployment. Baidu’s Ernie is one of 40 models approved by the Chinese government for public use.

Valuation

I think to best understand the upside potential in Apple, it’s important to understand how they currently make money.

Apple made approximately 58% of their revenue from iPhone sales in the most recent quarter (Apple 10Q). In my assumptions, I assume that this proportion stays the same due to iPhone revenue growing, but also other revenues increasing as well.

When assessing Apple’s market for advanced AI devices, Bank of America analysts noted that they expect to see an iPhone upgrade cycle, fueled by the increasing demand for generative AI solutions. It is also important to point out that in 2020 a significant number of iPhone users were already part of the iPhone Upgrade Program. These numbers have likely grown since. Along with this, 51% of US Apple users usually upgrade to a new model as soon as their provider allows it. Given these trends, I believe it’s reasonable to assume that a significant number of users would be interested in upgrading their iPhones to access new AI features.

According to one of the leading technology analysts on the street, Dan Ives, he estimates that Apple has 270 million iPhones in the upgrade cycle window due to new AI features and due to iPhone upgrade plans. In calendar year 2023, Apple sold 235 million iPhones, meaning this supercycle would have approximately 14.9% volume growth compared to last year.

In a previous super cycle around the iPhone 6, we saw a jump to 231.2 million units sold from 169.2 million the previous year. This represented a 36.7% jump in volumes. I think Dan Ives’ estimates (especially because the AI features are big upgrades) are reasonable at just a 14.9% volume growth.

On top of this, I believe that the ASP (average selling price) for the iPhone could go up this year due to new features. For reference, the lowest model iPhone in the current lineup goes for $799 in the US. While this is much higher than the MSRP of the original iPhone in 2007 (MSRP of $499), when you account for inflation this is $733 in 2024 dollars.

The baseline iPhone has only increased by $66 in real terms since 2007 even though the iPhone has more features (ex. the App Store and copy/paste both were not a thing on the first iPhone).

Previous iPhone generations (such as the iPhone X) had a starting price of $999. While these were accompanied by an iPhone 8 with a starting price of $699, the iPhone 8 now has an inflation adjusted price of $869.

Given this, I think we could see iPhone ASPs rise by $100 in nominal terms this upgrade cycle given the new AI features.

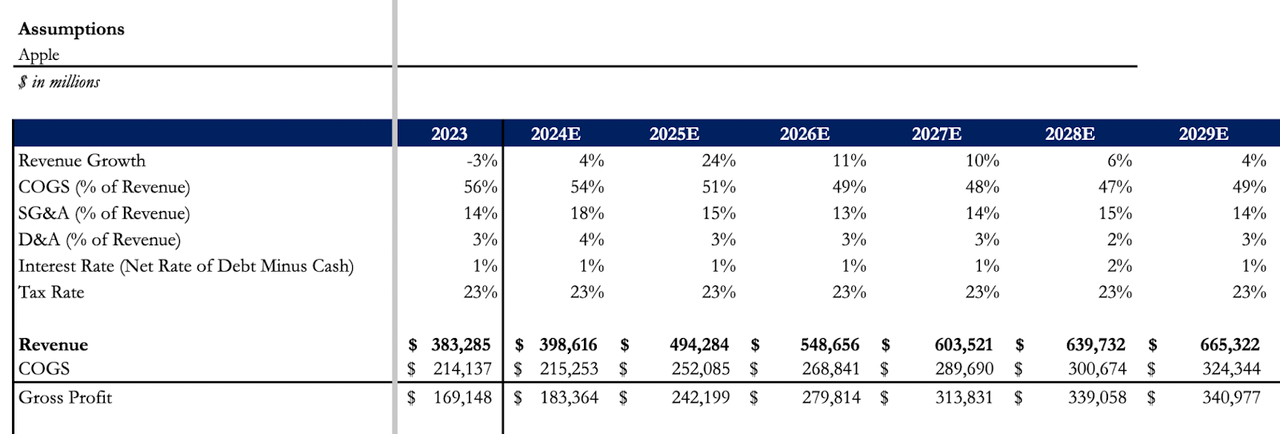

The rest of Apple I expect to grow at a similar rate, giving us a combined revenue growth for FY 2025 (year starting 10/1/2024) of 24%. I expect Apple to have subsequently better revenue growth from here as users benefit from AI services (analysts are forecasting these services will have a monthly subscription fee attached to them like ChatGPT+) and new AI features on their MacBook lineup (seeing a similar AI upgrade cycle like we will likely see with AI PCs). In addition, higher ASPs will help benefit revenue from users who upgrade in later years (FY 2026-FY 2028).

Apple Revenue Estimates (Noah’s Arc)

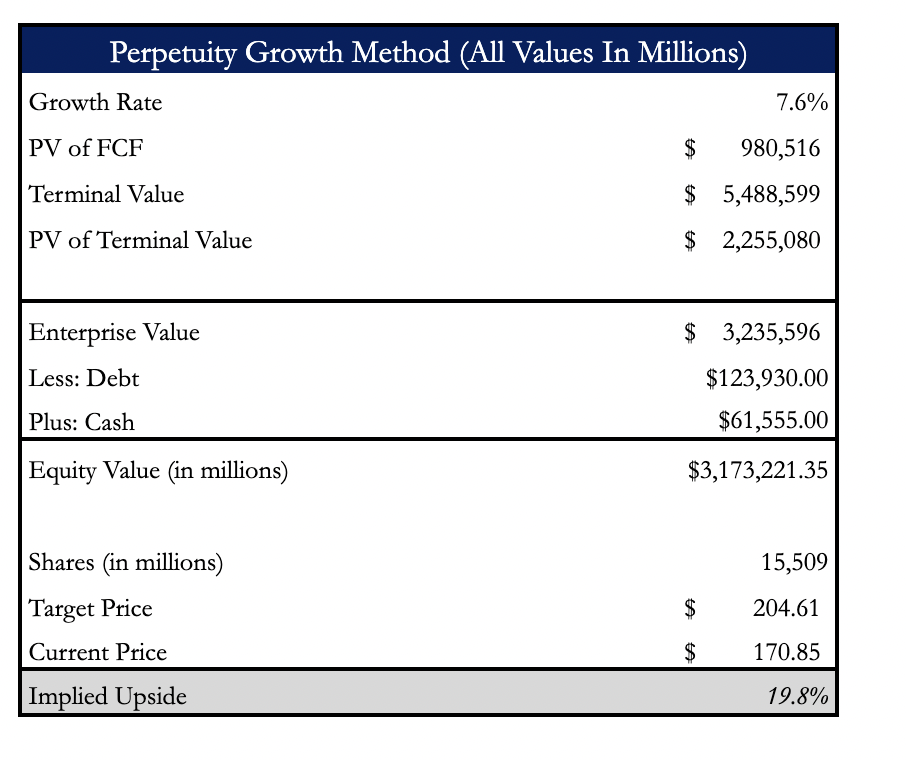

Given this, my model is showing that with a discount rate of 9.3%, Apple has a future PV of $204.61/share. This implies equity upside of about ~20% from where Apple stock was as of the time of this writing. This would also be an all time high.

Keep in mind that this assumption assumes no share buybacks (which Apple has been aggressively doing). I expect share buybacks to increase EPS and enable investors to apply a higher P/E multiple to this (which could give a higher share price from what the model is saying).

Apple DCF Analysis (Noah’s Arc)

Where This Fits In With My Previous Apple Research

Last December, I wrote up a research arguing that Apple will benefit immensely from new healthcare trends, which could unlock upside in the technology giant’s stock. While I continue to believe that Apple will have upside potential, I recognize that the company has more headwinds now (China sales, DOJ lawsuit, European regulatory risk) that they did not have in December. I believe that all of these concerns will eventually abate, but for now I want to give a valuation that is more conservative, yet offers more routes for upside.

To be more specific, last time I argued that Apple had upside in its shares due to what I believed to be a $100 billion opportunity in the healthcare market. I applied a price to sales multiple of 6 to this revenue to generate an upside potential of $600 billion in market cap from where the company was in December.

Since then, the slowdown in sales in China has caused the residual value of Apple (not including healthcare opportunities) to decrease. In addition, the DOJ lawsuit in the US has opened up the risk that Apple could be forced to allow more competitors onto their platform of 2.2 billion devices. This means that the revenue opportunities in healthcare to the company could be diminished as other healthcare focused companies are now able to leverage the Apple ecosystem better.

In essence, this has made me lower my price target to roughly $204/share from $237.70/share previously. That being said, if Apple still reaches $237.70/share I would not be surprised, but I now view $204/share as a much more achievable and realistic price target given where the company is today.

Risk to Thesis

Although Apple currently has a solid position in the tech landscape, they still face risks that could potentially impact this position, especially in the Chinese market. As I mentioned before, Apple has seen a decline in sales, with a drop of 24% in the first six weeks of 2024, and seems likely caused by local competition from brands, such as Huawei, Vivo, and Xiaomi.

On top of this, recent lawsuits by the DOJ in the US, and new enforcement actions by the EU still loom large. While both enforcement actions are worrisome, I actually think Apple’s AI strategy will help fight these, especially in the US.

For example, one of the biggest complaints in the DOJ lawsuit is that Apple has been using their platform to hinder apps from being successful on their platform. Part of this has been the 30% app store fee Apple is charging for apps to list on the app store.

Recent proposed partnerships with Google, OpenAI, or even Baidu can help offset this. It can show how Apple is willing to bring in outside major tech players and allow them to interact with the iOS ecosystem in a way that was previously just reserved for Siri or Apple approved services, which were subject to the 30% revenue cut. All the while, it allows Apple to get best in class LLMs integrated in their hardware just in time for the latest upgrade cycle.

On top of this, one of the major issues in China has been that the government has banned the use of Apple iPhones for government employees on national security concerns. Integrating a mainland China provider like Baidu into their operating system to handle AI-based queries is a great way to help mitigate this concern. Notably, Apple CEO Tim Cook went to Shanghai last week to help shore up the technology giants relationship in China. Part of this trip, it appears, were discussions with Baidu.

In this specific case, Apple analyst (with a solid track record) Gene Munster gives this Baidu deal a 75% chance of closing. I am optimistic as well and think this is a great risk mitigation strategy. In the US, the adoption of an LLM from either OpenAI or Google could allow Apple to thwart some of the concerns of the DOJ lawsuit by showing how they can welcome outside companies into what many have described as a “walled garden.”

How I Will Be Monitoring My Thesis

Much like with my healthcare research I published in December, I’ll be watching how Apple deals with regulatory actions out of the US and EU. In addition, I will be watching reports on how their LLM integrations into iOS 18 are going since I see this as key to the upgrade cycle going into the likely new iPhone release in the fall. I expect over the next few months (and during the next earnings call) for the iPhone maker to be discussing more and more on their calls on what the AI expectations should be for Wall Street and Investors.

As always, the best source in the long run will be Apple themselves. However, since they are so quiet on their movements, I tend to watch analysts like Gene Munster and Dan Ives for earlier cues to help understand where the company is going and get an edge.

Bottom Line

Apple is one of the leading figures worldwide in the tech industry, but the challenges in the competitive Chinese market and recent regulatory actions in the US and Europe showcase how the landscape is changing. Despite these setbacks, I believe Apple’s commitment to innovation, specifically through the integration of partners’ AI across their product lineup, will soon reverse these struggles. Combining the development of outside LLMs along with hints towards the planned upgrades around iOS 18 show that Apple aims to not only to hold their market share but also redefine user experiences. I believe the company has an excellent trajectory ahead of them and recent regulatory challenges and a slowdown in China is just noise. I think the stock is a strong buy.