Apple: Apple Intelligence Has Limited Impact On Revenue Growth (NASDAQ:AAPL) – Technologist

ozgurdonmaz

Investment Thesis

Apple (NASDAQ:NASDAQ:AAPL)’s stock recouped some of its recent losses after reporting 3Q FY2024 earnings that exceeded both revenue and GAAP EPS estimates. While iPhone revenue continued to decline YoY, particularly in the Greater China segment, investors appear to be looking beyond the short-term growth weakness and focusing on the upcoming AI upgrade cycle. In my last coverage, I issued a hold rating on the stock due to its premium valuation, which posed a downside risk if AI features did not significantly boost product sales. Additionally, AAPL’s substantial weighting in the S&P 500 index presents a concentration risk. Recently, we observed that Warren Buffett’s Berkshire Hathaway reduced its AAPL holdings by 50%. Despite the launch of the iPhone 16 and the release of AI features across multiple operating systems, the company provided guidance for 4Q FY2024 that indicates no growth acceleration compared to the previous quarter. Therefore, I downgraded my hold rating to sell on the stock, as I believe the overstretched valuation will limit AAPL’s upside potential unless there is a significant improvement in revenue growth.

Apple Intelligence Is a Staggered Launch

During the recent earnings call, the management indicated that they would not immediately roll out the full suite of Apple Intelligence features to developers. Some features, particularly those involving languages beyond U.S. English, are expected to take over a year to release, which may overshadow the demand for iPhone upgrades in non-English speaking countries. Therefore, while I do anticipate a rebound in product sales growth, I’m kind of skeptical that Apple Intelligence will significantly drive demand for upgrades in the near term. CFO Luca Maestri stated during the call, “we are going to be growing total company revenue at a rate that is similar to what we reported, so the plus 5%.” This indicates that AAPL’s top-line growth will remain on its previous trajectory.

Moreover, since the existing iPhone 15 Pro and Pro Max models will support Apple Intelligence features under iOS 18, it’s possible that consumers may continue using current devices rather than upgrading to newer models like the iPhone 16. This could justify the lack of a growth pickup in 3Q FY2024 and the muted net sales guidance for the 4Q.

iPhone Sales Is Still Declining

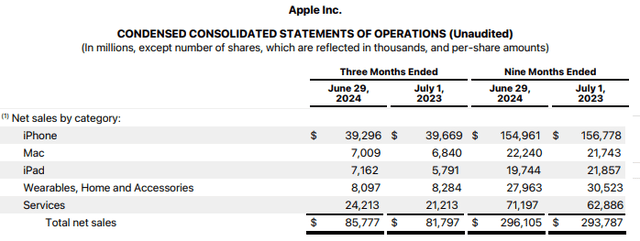

3Q FY2024 Financial Statements

The company’s iPhone sales slightly topped the market consensus in 3Q FY2024, but still showed a 0.94% YoY decline, reflecting some sequential improvement from a 4.3% YoY decline in 2Q FY2024. The management attributed the decline largely to FX headwinds. Nevertheless, the iPhone installed base continued to reach all-time highs last quarter. While the imminent upgrade cycle may improve iPhone sales growth, I believe the growth will be modest, as indicated by the company’s guidance.

Financial Times

While Americas segment experienced strong growth in net sales in 3Q, the Greater China segment continued to drag down total net sales, declining by 6% YoY, slightly improved from a -8.1% YoY growth in the previous quarter. According to the data, iPhone has dropped out of the top 5 in China sales as the device shipments slid by 3.1% in China compared to 8.9% YoY overall smartphone shipments during the last quarter. Competitors like Huawei and Xiaomi are currently outpacing the iPhone. Meanwhile, the Chinese government’s crackdown on iPhones is likely to structurally shift its growth trajectory. Given the geopolitical uncertainty and country-specific risks, I’m cautious about the long-term growth of iPhone sales in China.

Muted Margins Outlook in 4Q FY2024

AAPL reported sequential decline in gross margins across all business segments in 3Q FY2024, which did not exceed the high end of their previous guidance. The management forecasts flat QoQ gross margin in 4Q FY2024 in a range of 45.5% to 46.5%, compared to 46.3% in 3Q. Meanwhile, they also expect a midpoint of $14.3 billion in operating expense in 4Q, in-line with the previous quarter. This implies a limited upside of its operating margin in the coming quarter. As a result, I do not anticipate a meaningful growth reacceleration in its EPS in 4Q.

The Stock Has Too Much Concentration Risk

In this section, I want to discuss the risk of owning AAPL shares from a portfolio construction standpoint. Recently, Berkshire Hathaway reduced its stake by 50% in the latest quarter. If you are a risk manager overseeing a pension fund or mutual fund portfolio with a significant portion in broad-based index ETFs like SPY or QQQ, you may want to reconsider adding more AAPL shares. I believe that the increased volatility in the current stock market is largely driven by momentum traders heavily utilizing derivatives such as options and futures on these benchmark composites. Since AAPL holds the largest weight in the S&P 500 index and Nasdaq index, the stock’s fair value could be overshadowed by these non-fundamental factors. Therefore, I believe AAPL is not a buy at this level, especially given its premium valuation.

Valuation

Seeking Alpha

AAPL is currently trading at 34x GAAP P/E TTM, making me less bullish on the stock. The stock is approaching the highest valuation since the FY2021 pandemic era when interest rates were near zero. Its multiple is also approaching its 10-year upper bound. According to Seeking Alpha, all of AAPL’s valuation multiples are at least 20% above their 5-year averages. Furthermore, AAPL’s non-GAAP forward P/E sits at 33.8x, higher than the Nasdaq 100 index’s P/E of 29x. While this premium valuation may reflect the imminent upgrade cycle under Apple Intelligence, I believe the forward-looking market has likely already priced in the good news given the current YoY decline in iPhone revenue. Moreover, the stock’s concentration risk and structural growth slowdown in China lead me to bearish on AAPL at the moment.

Conclusion

In conclusion, while AAPL has shown resilience by delivering better-than-expected 3Q FY2024 results, I believe the company’s upside potential is limited from here. The anticipated AI upgrade cycle and the staggered release of Apple Intelligence features are unlikely to drive substantial near-term demand for iPhone upgrades, particularly in non-English speaking regions. The ongoing decline in iPhone sales, especially in China, combined with muted margins and a mediocre 4Q FY2024 net sales outlook, suggests that the AI-driven tailwinds are largely priced in. Additionally, the recent reduction in AAPL holdings by Berkshire Hathaway not only signaled the concentration risk for investors but also implied a less attractive valuation. Given these factors, I downgraded to sell rating on AAPL unless revenue growth significantly improves in the coming quarters.