Apple Faces Massive Hurdles In The AI Race (NASDAQ:AAPL) – Technologist

Nikada/iStock Unreleased via Getty Images

Apple’s (NASDAQ:AAPL) recent AI announcement has been received very positively by Wall Street. The stock is trading as if the company has already delivered a “supercycle” leaving little room for further upside potential. At 32 times the forward PE ratio, Apple stock is trading at twice the historical average before the pandemic. Apple’s AI efforts have already hit a major roadblock as EU regulators have warned the company’s App Store will breach their rules. Apple has backtracked from rolling out its AI tech in the EU, which contributes close to 25% of its total revenue base.

On the other hand, it is showing revenue decline in several key segments. It was mentioned in my previous Sell article in late March that Vision Pro has been overhyped, and it will fail to make a meaningful contribution to the revenue in the near term. This was proved right as Fast Company has recently mentioned that Apple is suspending work on Vision Pro 2 due to poor sales. The Wearables segment has also been reporting a double-digit revenue decline for the past few quarters.

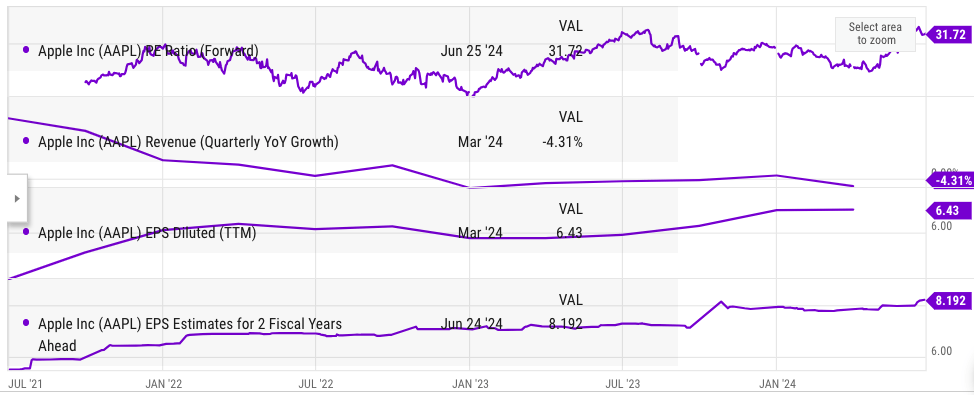

The current trailing-twelve-months EPS is $6.4 and this metric has not seen much growth since hitting the previous peak of $6.1 in the last quarter of 2021. The consensus EPS target for 2 fiscal years ahead is $8.2. This is a 28% jump in two years. It looks like Wall Street is already pricing in the probability that Apple will gain huge momentum through its next iPhone iteration. If the response of customers does not meet expectations in the next iteration, we could see a massive correction in Apple stock, which is trading at very high multiples. The upside potential for the stock is limited, while there is a significant downside risk.

Massive hurdles for Apple’s AI tech

The recent bullish run in Apple stock gave an impression that the company has already successfully launched its AI iPhone and there is a clear trajectory for future profits in this segment. Many analysts, including Deepwater’s Gene Munster have done optimistic math about the ability of this next iPhone to boost Apple’s EPS. Gene Munster has even mentioned that the AI iPhone would be a bigger deal than the first iPhone which brought touch screens.

However, there is a big issue in this optimistic analysis. The first problem is the enthusiasm of the average customer. There are no killer apps or “wow” effect in the next iteration. The average customer can be more attracted by a new form factor compared to some AI tools. The jury is still out over the reception of the next iPhone iteration, but it would be better to be more cautious when forecasting the impact on growth due to these AI features.

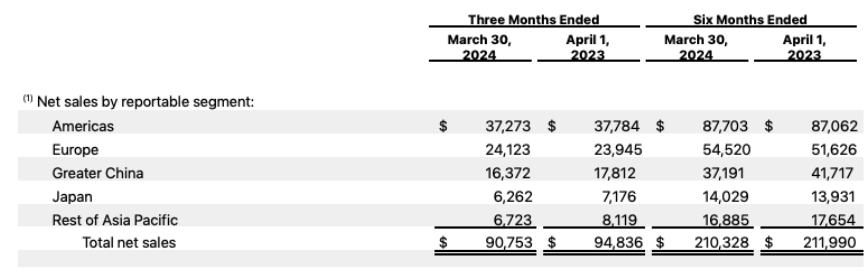

Another major issue is the regulatory challenges faced by Apple’s AI tech in other regions. Apple receives close to 40% of its revenue from the domestic US market. The European market contributed 25% of the total revenue base in the recent quarter, while the Greater China region contributed close to 18%. Recently, Apple has backtracked from plans to launch AI tech in the EU as it faces new regulatory hurdles. It is unlikely that it will launch these features in China. There are many other regions that might be hesitant to allow the AI tools that will be launched by Apple.

Company Filings

Figure: Apple’s revenue contribution from different regions. Source: Company Filings

Poor performance in other segments

There is a lot of hype around every single product or device launched by Apple. However, many of them fail to deliver the expected results. One of the recent examples is Vision Pro. The forecasted sales of Vision Pro will not match earlier estimates. I had predicted this in an article prior to the launch of the device. Another headwind for Vision Pro is that it requires massive investment in R&D. Apple does not break down the exact investment in Vision Pro. However, we can see that Meta has been investing billions of dollars in its Reality Labs segment. Over the last few years, Meta’s Reality Labs segment has had a loss of over $40 billion. The recent quarterly loss in Reality Labs was $3.85 billion, with an annualized rate of over $12 billion. Apple could be facing similar expenses in Vision Pro as it tries to build an entire ecosystem of services for the device.

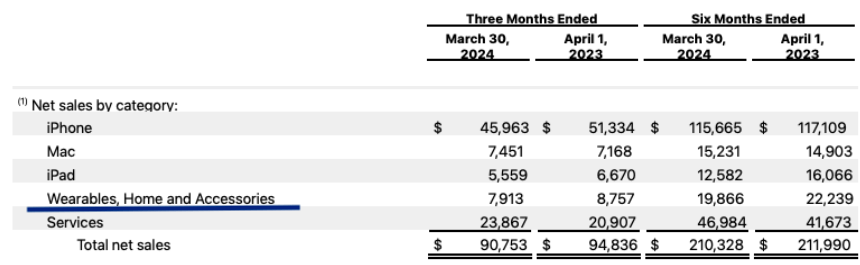

Company Filings

Figure: Decline in Wearable segment. Source: Company Filings

Another major segment facing headwinds is the Wearables, Home, and Accessories. This segment has reported close to double-digit YoY revenue decline in the recent quarter. This is on the back of another double-digit decline in the year-ago quarter. This can point towards some fundamental issues within this segment.

Google has recently announced reaching 100 million subscribers for YouTube Premium subscription. This is up from 50 million in late 2021. Apple has stopped announcing its subscriber base for Apple Music for the last few years, but it is highly likely that Google has raced ahead of Apple in this segment despite Apple having a first-mover advantage.

It is uncertain if new AI tools will lift the performance of these segments. If Apple continues to face headwinds in these segments, it would certainly hurt the ability of the company to increase its user base and monetize them.

EPS growth target is too optimistic

Apple hit $6.1 EPS in the previous peak in 2021. Since then, the company has relied on buybacks to boost EPS as revenue declines. The recent EPS is $6.4 which shows modest growth in the last few years despite massive buybacks. The consensus EPS estimate for 2 fiscal years ahead is $8.2. This is equal to 28% growth in the next two years. I believe this EPS growth estimate is quite high as the company faces headwinds in several segments.

Ycharts

Figure: Key metrics of Apple. Source: Ycharts

Back in early 2022, Apple’s EPS estimate for 2 fiscal years ahead was close to $7. The current EPS of $6.4 is nowhere near this number, which shows the positive bias towards Apple’s future EPS growth. The current EPS estimate for 2 fiscal years ahead is $8.2 which would be very difficult to reach unless the company can really bring out some revolutionary product that causes a real “supercycle”.

The last major EPS growth period came during the pandemic, and it was a very unique situation as the sales of all tech products increased which helped the products and services of Apple. We are unlikely to see a similar tailwind in the next few quarters which makes the current forward EPS estimate unrealistic.

Apple’s forward PE ratio is 32 which is more than twice its pre-pandemic average. On the other hand, the company has consistently shown poor revenue growth. If the company fails to meet the expectations of its AI tech, we could see a big correction from the current elevated multiple. If Apple was trading at its pre-pandemic average of 15 times PE ratio, the stock would be close to $125 or 40% less than the current price. As mentioned above, many important segments of Apple are facing headwinds and any poor reception of the next iPhone iteration can cause significant correction.

The downside risks for Apple stock are quite strong making it a Sell at the current price.

Investor Takeaway

Apple has seen another bullish rally as it announced new AI tech for its devices. However, it is facing regulatory setbacks and will not be launching the AI tech in the EU, which contributes 25% of the total revenue base. The company has also been facing headwinds in other segments like Vision Pro, Wearables and Apple Music.

The forward PE ratio is at 32 which is the highest it has been over the last few years. The forward EPS estimate for the last few quarters was off the mark as the company reported falling revenue. The EPS estimate for 2 fiscal years ahead is $8.2 which is 28% higher than the current EPS. It would be very difficult for the company to deliver this EPS unless the next few iPhone iterations are a massive hit. This is becoming more difficult for the company as many important regions prevent Apple from launching its AI tech. Investors should be cautious of the current valuation of Apple, as any negative news can cause a big correction. I rate the stock a Sell at the current price.