Apple Q3: I Disagree With Bears’ Interpretation Of Berkshire Divestiture (NASDAQ:AAPL) – Technologist

Andrii Yalanskyi

AAPL stock FY Q3 recap

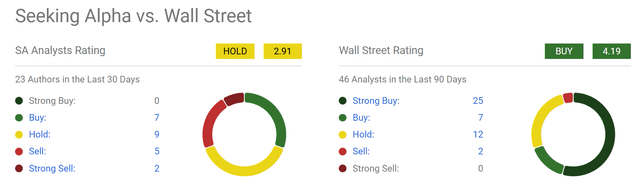

Since Apple Inc. (NASDAQ:AAPL) released its FY Q3 earnings report (ER), the sentiment surrounding the stock has changed substantially among Seeking Alpha authors. As you can see from the chart below, Seeking Alpha authors have become more cautious (say, compared to Wall Street analysts) on the stock, with a consensus rating of Hold and a weighted average rating of 2.91. A total of 23 articles were published on the stock in the past 30 days (and a large proportion of them were published in the past few days since the Q3 earnings report). None of the articles have given it a Strong Buy. The majority of the ratings were either at a Hold or below as seen.

Seeking Alpha

Looking through articles more closely, the cautious/bearish sentiment largely stems from 3 concerns: the slowing iPhone sales, the high valuation multiple, and the recent substantial divestitures by Berkshire Hathaway of its AAPL position.

Against this background, the goal of this article is to explain why all three concerns overstated the downside risks (or are even misplaced). I’ve touched on the first two concerns in my earlier articles. Therefore, I will be brief with them and will mostly concentrate on the third issue here in this article.

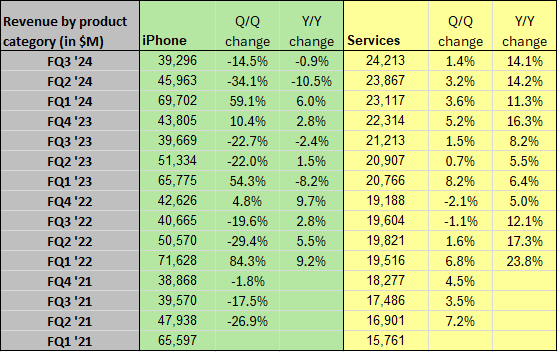

Let me start with the iPhone sales. Bears have a good reason here as the iPhone sales growth has been dwindling recently. For example, the chart below shows AAPL stock’s iPhone sales reported in its Q3 ER. As seen, its iPhone revenue has indeed been struggling recently. There was a sharp decline of 10.5% YOY in iPhone revenue in FQ2 ’24, which was followed by another slight decline of -0.9% FQ3 ’24. However, my view is that investors should begin to pay more attention to its service revenues as the company is no longer a hardware company anymore. This point is the focus of my previous article and readers can check it out for more details. As seen in the chart below, Apple’s services revenue kept posting double-digit annual growth rates in recent quarters. To wit, Q3’s service revenues reached a record $24.2 billion, translating into an annual growth rate of 14.1%. Service revenues tend to enjoy higher margins and are more recurring. I expect the growth to persist thanks to AAPL’s huge installed base and loyal fans, which should offset any iPhone volume decline – if any in the years to come.

Seeking Alpha

AAPL stock: Berkshire divestiture

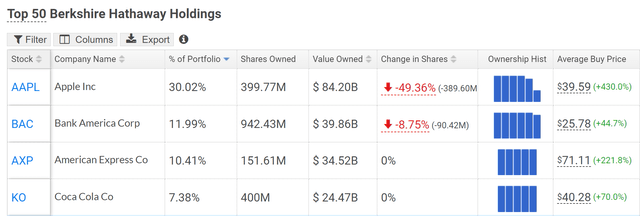

Now, let me move on to the main issue today – Berkshire’s large divestiture of its AAPL position. The chart below shows the changes in Berkshire’s top equity holdings reported in its latest disclosure. As seen, Apple remains in the largest position, though its weight has dropped significantly from 49.36% to 30.02% as Berkshire reduced its stake by almost half (49.3% to be exact).

Source: hedgefollow.com

The prevailing view is that such divestiture reflects Buffett’s bearish view of AAPL stock (and/or the broader equity market). Well, I beg to differ, for so many reasons. To refrain from rambling, I will limit myself only to the top 3 reasons on my list.

First, the interpretation simply missed the fact that BRK still holds more than $84 billion of AAPL shares. As seen in the chart above, the remaining AAPL position is still more than 30% of its total equity portfolio and is still a concentrated bet on AAPL even by Buffett’s standard.

Second, BRK can trim its AAPL exposure (or equity exposure) for various reasons even though Buffett still has a positive view of AAPL. These reasons can include tax considerations, the need for its other operating segments (e.g., insurance float), the possibility of a sizable acquisition, etc.

Finally and most importantly, cash is way more potent in the hands of BRK than for ordinary investors. Let’s say BRK’s trimming of AAPL and other stock positions indeed reflects Buffett’s bearish view on these companies and the overall economy (which, bear in mind, is speculation), it does not mean that we should trim our positions too. The reason is quite simple, BRK has far more alternative ways to deploy its cash beyond buying stocks or bonds. Recent examples include the deals it structured to invest in Occidental Petroleum Corporation (OXY) and Bank of America (BAC). These deals offer far more favorable return/risk profiles than directly purchasing the shares in my view and are not available to ordinary investors.

As to be argued below, within the investment universe available to individual investors, I see little odds of finding alternatives with noticeably better return/risk ratios than AAPL.

AAPL stock: valuation and projected return

Finally, let me briefly address the valuation concern. Despite the price corrections amid the market panic, the current FWD P/E is ~31.3x for AAPL. It is certainly not cheap in absolute or relative terms. However, as repeatedly argued in my earlier articles,

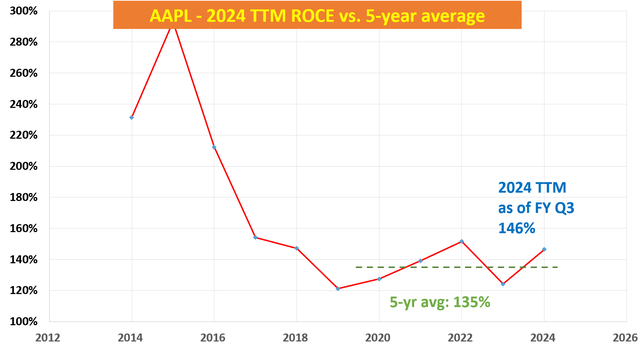

Long-term investors who think like business owners should not be automatically turned off by a ~30x P/E for stocks like AAPL with superb ROCE (return on capital employed). The reasoning is quite simple and involves only napkin math. As seen in the next chart, AAPL’s ROCE is about 146% on a TTM basis based on the financials it reported in Q3 2024. With such a ROCE, a 5% investment rate would drive about 7% of organic growth (146% ROCE * 5% reinvestment rate ~ 7% growth rate). A ~30x P/E provides ~3% of earnings yield.

Considering AAPL’s capital-light model and the growing service revenues as just aforementioned, the owners’ earnings yield is even higher (about 4.5% by my estimate). Thus, the total annual return potential in the long term is still in the double-digits despite the 31x P/E, which is far better than the return I expect from the overall market (about 6% under its current P/E).

Author

Other risks and final thoughts

In terms of downside risks, AAPL, like its tech peers, faces common risks such as economic downturns, increased competition, rapid technological evolution, etc. Here, I will focus on a risk that is more immediate and particular to AAPL: the implications of the recent ruling regarding Google’s (GOOG) (GOOGL) monopolistic practices. The U.S. Justice Department recently ruled that GOOG’s practices surrounding its search engines were to be considered a monopolist. Apple is unlikely to see an immediate impact from this ruling according to analysts from leading investment groups such as Bernstein. However, I think the potential impacts can be larger than expected. Apple has had lucrative deals with Google in the past and the deal could be jeopardized by the ruling. More specifically, GOOG paid Apple over $20 billion a year in recent years to give Google search engine default placement at Apple devices’ key search access points. As a result of the ruling, AAPL’s most likely move in my view would be to open up the placement for a bit among various search vendors – which could cause earnings uncertainties. As a less likely move, AAPL could develop its own search engine, which is also likely to cause near-term profit headwinds.

All told, my verdict is that the upside potential outweighs the negatives under current conditions judging by the results and business fundamentals reported in its Q3 ER. In particular, I don’t suggest investors be overly sensitive to its quarterly iPhone sales (instead, focus more on its service revenues going forward) or equate BRK’s reduction as a bearish signal.