Apple Q3 Preview: Weak China Growth Ahead (Rating Downgrade) (NASDAQ:AAPL) – Technologist

Tom Werner

I reiterated my ‘Buy’ rating for Apple (NASDAQ:AAPL) in my previous article published in May 2024, highlighting its strong growth in service business. Since my last report, the stock price has surged by more than 19%, significantly outperforming the S&P 500 index (SP500). Apple is set to report its Q3 result on August 1st. I anticipate strong growth in its service business but weak iPhone revenue growth for FY24. As the stock price is overvalued, as per my calculation, I downgrade to a ‘Sell’ rating with fair value of $180 per share.

Flat iPhone Growth Expected

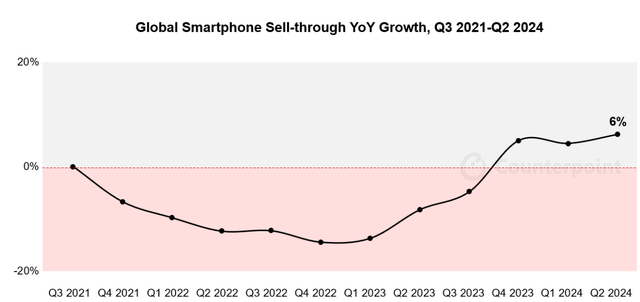

According to the latest Counterpoint report released on July 15th, global smartphone sell-through grew 6% year-over-year for the third consecutive quarter, as illustrated in the chart below.

Counterpoint Report (As of July 15th 2024)

However, Apple’s global iPhone sales are expected to remain flat in the Counterpoint report, with strong growth in Europe and LATAM, being offset by weak sales in China. As discussed in my previous article, Apple is facing strong competition from Huawei in China. In April 2024, as reported by the media, Huawei launched its Pura 70 series of smartphones, continuing to create growth challenges for Apple in China. Greater China accounted for more than 18% of total revenue in FY23; therefore, China remains a very important market for Apple.

I expect Apple’s smartphone business in China will continue to lose market share to local players, such as Huawei and Xiaomi, and the key reasons are as follows:

- With the increasing geopolitical tensions between the U.S. and China, the iPhone is unlikely to be favored in the domestic market in China due to the patriotism among Chinese local consumers.

- The high-net-worth individuals in China favor the iPhone brand; however, the penetration of wealth Chinese is close to the end, in my opinion. In the near future, iPhone’s growth in China will primarily be driven by replacement cycles.

- The rise of Huawei and its in-house developed chips could potentially create significant growth challenges for Apple in China.

Strong Service Growth Ahead

Services accounted for over 26% of total revenue in the past quarter, growing 14% year-over-year. As discussed in my previous coverages, I anticipate services will become the new growth driver for Apple in the near future. Apple possesses significant advantages in the service market, including:

- The massive number of devices in its installed base enables Apple to further grow its subscription, App stores, payment and other services. Only Apple has the capability to leverage its devices to expand its service business.

- Apple has been integrating AI into its apps and ecosystem of hardware and service. On June 10th, OpenAI and Apple announced partnership to integrate ChatGPT into Apple experiences, including iOS, iPadOS and mac OS systems. I anticipate Apple will integrate more AI functionalities into its operating systems and hardware in the future, driving more subscriptions revenue growth.

Overall, I estimate Apple’s service business will continue to grow at mid-teens, contributing 4%-5% to the topline growth.

Outlook and Valuation

FY24 would be a transitional year for Apple, as the iPhone 16 lineup is due to launch in September 2024. Based on the performance of the first two quarters, I estimate Apple will deliver 3% revenue growth in FY24, with services adding 4% to topline growth and devices dragging down total growth by 1%.

From FY25 onwards, I forecast Apple’s normalized revenue growth to be 9%, assuming:

- As discussed, I anticipate Apple’s service business will grow by 15% annually, contributing 4%-5% to the overall topline growth. The key growth drivers are the increasing device installed base, more types of services provided by iPhone ecosystems and ARPU growth.

- For other hardware business, I assume Apple will deliver 7% organic revenue growth, aligned with its historical growth average.

I anticipate 20bps operating margin expansion annually, primary driven by:

- 10bps expansion from gross profits, driven by increasing service business with better margin profile.

- 10bps operating leverage from SG&A

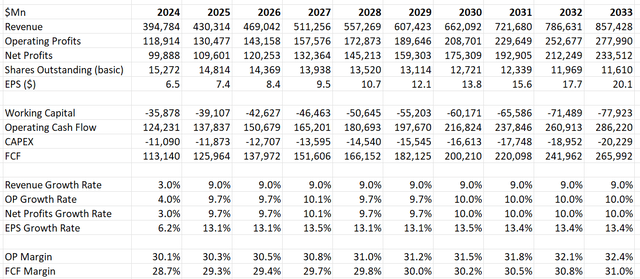

The DCF summary can be found as follows:

Apple DCF – Author’s Calculations

The WACC is calculated to be 12.5% assuming:

- Risk free rate: 4.2% (US 10Y treasury yield)

- Beta: 1.19 (SA)

- Tax rate: 16%

- Equity risk premium 7%; cost of debt 7%.

- Equity balance $3.34 trillion; debt balance $111 billion

The fair value of Apple’s stock is calculated to be $180 per share after discounting all the future FCF.

Key Risks

As reported by the media, the European Union fined Apple €1.84 billion for breaking its competition laws for preventing Spotify (SPOT) from advising app users cheaper ways to subscribe outside of Apple’s app store. It is evident that Apple App Store is charging a 15-20% cut from any payment within the store. I believe the similar complaints will arise in the future, as this fee cut percentage is quite material for app developers.

On July 24th, Spain’s competition authority, the CNMC, announced the investigation into Apple’s App Store. It is too early to predict the outcome of the investigation; however, these investigations could force Apple to change its policies for its App store payment.

As I give Apple a ‘Sell’ rating, I am considering the following upside risks:

- Apple plans to allocate $110 billion towards shares repurchase, increasing the amount of capital returned to shareholder. The massive shares repurchase could potentially boost Apple’s stock price in the near-term.

- Apple could possibly deliver higher-than-expected service revenue growth, which could please the market. I have to acknowledge that Apple is quite strong in cloud, video, payment solutions, streaming and other services.

End Note

While I anticipate iPhone revenue growth to be under pressure in the near term caused by weak China sales, Apple’s services would continue to grow at mid-teens, contributing growth for Apple. However, the stock price is overvalued as per my calculations, I downgrade to a ‘Sell’ rating with fair value of $180 per share.