Apple Q3: Solid Performance Overshadowed By Lofty Valuation (NASDAQ:AAPL) – Technologist

ozgurdonmaz

Investment Thesis

Apple (NASDAQ:AAPL) is one of the finest examples of enterprise in existence at least by my standards.

The firm continues to enjoy the benefits of their wide and robust economic moat, which is built upon the sale of great quality products that tightly integrate hardware and software solutions so as to create a great user experience that subsequently generates customer loyalty.

Considering the challenging macroeconomic backdrop, Apple still managed to achieve tangible top line growth which, when combined with efficiency improvements, led to some solid bottom line results.

Nevertheless, shares continue to trade at a real premium relative to their intrinsic value, with my base-case model suggesting an 18% overvaluation.

As a result, I am still unable to advocate for the building of a position in the firm. Due to the magnitude of uncertainties facing both the markets and Apple, I would even consider trimming exposure in the firm, hence my Sell rating.

Business Overview

Apple continues to be one of the most influential technology companies in the world. From their headquarters in Cupertino, CA, the firm creates some of the finest consumer-grade tech products, ranging from their flagship iPhone and iPad lineup all the way to computers with their Mac range.

The company continues to innovate within the industry with the Vision Pro spatial computing (which is just a buzzword for augmented reality) headset.

While my full in-depth analysis of Apple’s economic moat was written over a year ago, I still believe it holds true today and thus suggest you read it here to gain a deeper understanding of their business.

In summary, the firm continues to benefit from a wide economic moat rating in my opinion, given the high degree to which Apple has intertwined their hardware and software products.

By ensuring their ecosystem is essentially void from external third-party applications, Apple has managed to generate significant loyalty among its consumers, which benefits the company massively through repeat sales.

While the recent lawsuit introduced against Apple by the DOJ regarding potentially monopolistic business practices could result in the firm being forced to allow more third-party solutions into their ecosystem, I believe the end result will be negligible for the firm.

The benefits tight integration between hardware and software presents users both from a convenience and overall user experience standpoint is simply so large that I would suspect most current customers would balk at switching their payments processor or music provider away from Apple’s own solutions.

Fiscal Analysis – Q3 FY24 Update

August 1, 2024 saw Apple release their third-quarter results, which I saw as ultimately being quite positive for the firm.

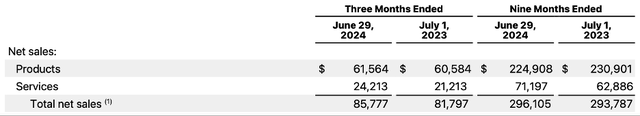

AAPL FY24 Q3 Consolidated Earnings Report

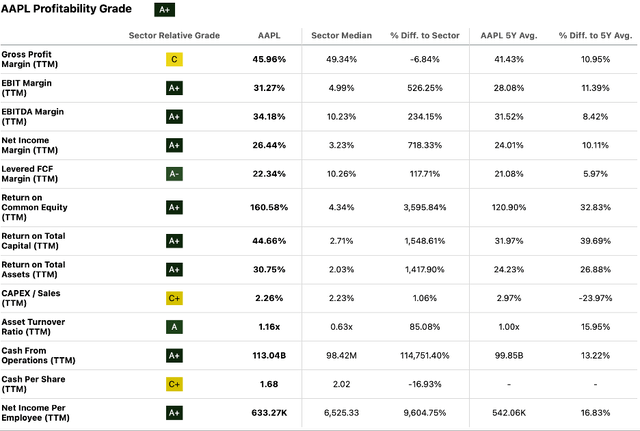

Strong growth in net sales of their hardware devices allowed the firm to record a solid 1.6% YoY increase in Products revenues for the quarter.

AAPL FY24 Q3 Consolidated Earnings Report

While the absolute growth was quite limited, I believe the ability for Apple to continue growing their device sales amid a widespread exhaustion of consumer coffers is quite impressive. This feat becomes even more apparent when considering how expensive many of their products are, especially compared to cheaper devices from competitors.

Apple’s Services segment also saw great top-line net sales growth of 14.2% YoY, which came mostly thanks to an increasing amount of subscribers for the firm’s software services such as Apple TV+ and Apple Music.

Ultimately, I believe the growth achieved in both of Apple’s key segments illustrates the continued influence the firm holds among consumers, and thus supports my earlier thesis that their economic moat remains wide and robust.

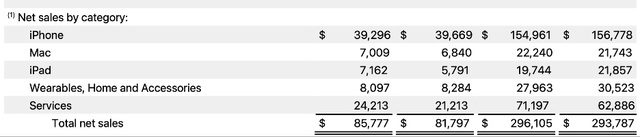

AAPL FY24 Q3 Consolidated Earnings Report

Careful management of the firm’s supply chains and production processes – a practice that the Cupertino giant has historically been superb at – continues to be a boon for the firm’s earnings.

COGS for their products and services segments only increased 1.8% YoY and 0.8% YoY, respectively, which is quite impressive in my opinion.

Considering the overall increase in pricing levels since 2023 along with the possibility of a less optimised Vision Pro supply chain being accounted, I see the only marginal downgrade in gross margins for the Products segment as acceptable.

Regarding the 0.8% increase in Services COGS, I can only describe my profound appreciation for such sound enterprise economics.

In a time where many streaming and subscription services providers are only barely achieving economic of scale that would yield tangible margins for their services, Apple continues to easily expand the volume of products provided to customers with essentially nil impact on their operating costs.

I believe it is the firm’s dedication to balancing the production of wonderful products and services which afford significant pricing power alongside strict fiscal responsibility that ultimately allows Apple to generate such robust margins on their business.

Accordingly, the firm’s overall gross margin expanded 9% YoY to about 46%.

Apple continued to increase R&D spending by about 8% YoY as the firm undoubtedly continues to pursue silicon improvements for their M series of chips and potentially new software and hardware products for clients.

Apple’s bottom-line net income figure grew 8% YoY in Q3, totaling just under $21.5 billion. These results certainly outperformed my expectations, given the increasingly limited discretionary income consumers have to spend on luxury tech goods such as Apple products.

A quick peek at Apple’s coffers through their balance sheets presents essentially no material changes in my opinion. The firm continues to exhibit exceptional capital allocation practices, with total assets of around $332 billion easily exceeding total liabilities of $265 billion.

With over $25 billion in cash and cash equivalents along with low inventories of just $6.2 billion, I believe the firm is continuing to manage their finances and sales effectively.

Interestingly, the decrease in total current assets in particular (a combination of a shaving of $5 billion in cash on hand along with an $11 billion drop in vendor non-trade receivables) has resulted in the firm’s quick and current ratios dropping to about 0.80x and 0.98x respectively.

While these metrics would theoretically suggest that Apple’s short-term liabilities exceed short-term assets, the truly minute imbalance is made essentially irrelevant by the absolutely massive $91.5 billion in cash generated by operating activities in the third-quarter.

Overall, I believe Apple continues to produce some exceptional (especially when considered relatively against competitors) fiscal results which suggest that their fundamental moat and business model remain competitive in the market.

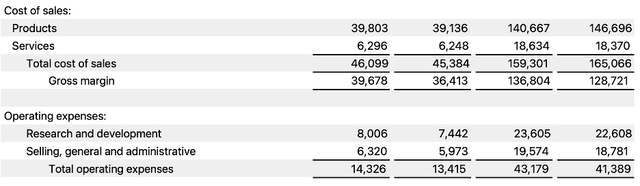

Seeking Alpha | AAPL | Profitability

Seeking Alpha’s quant echoes my sentiment with a profitability grade of “A+” for Apple. The truly exceptional ROIC and ROA of 45% and 31% respectively further highlight the magnitude of Apple’s fiscal proficiency.

Valuation

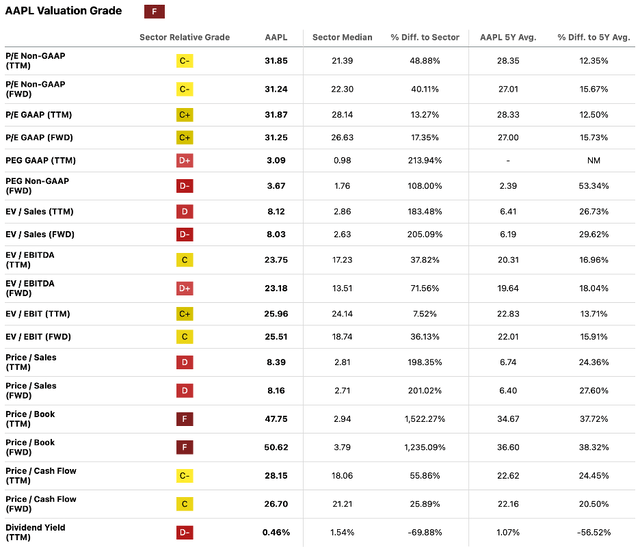

Seeking Alpha | AAPL | Valuation

Considering my praise for Apple’s earnings report, I have not failed to consider how some readers may be pensive as to why I have continued to hold a negative “Sell” rating for the firm’s stock.

This unfortunately comes as a result of the relatively pricey valuation AAPL stock currently has, as evidenced initially by Seeking Alpha’s Quant producing an “F” rating for the company’s shares.

The 31.9x P/E GAAP TTM ratio is 12.5% above the 5Y mean for Apple, while also resting over 13% above the information technology sector median.

Similarly, elevated ratios can be seen with the firm’s current P/S TTM ratio of 8.16x, their P/CF TTM ratio of 28.15x or even the current EV/Sales TTM ratio of 8.12x.

Any firm which has their sales for the past 12-months being valued at over 8% the actual sum should be growing at a truly remarkable rate for such an elevated metric to be warranted.

While I do find Apple’s continued growth of net incomes and margins to be positive for the firm, they are nowhere near the levels that would rationally warrant such a pricey stock valuation.

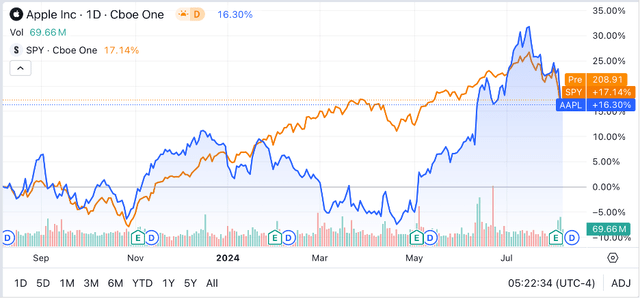

Seeking Alpha | AAPL | 1Y Advanced Chart

Analysis of Seeking Alpha’s 1Y Advanced Chart for AAPL stock illustrates perfectly how Apple’s stock valuation has changed over the past 12-months.

While valuations have already dropped by almost 15% since recent highs witnessed in early July, the stock has been surprisingly volatile despite earnings data being quite consistent for the firm.

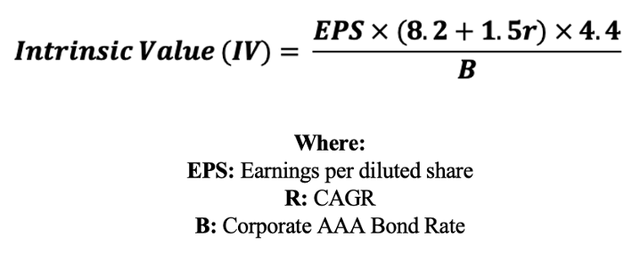

The Value Corner

To gain a more objective and quantitatively derived valuation figure for AAPL stock, I used my Intrinsic Value Formula (above).

Using the current share price of $207.23, an updated mean analyst estimated 2024 EPS of $6.70 a realistic r value of 0.11 (11%) and the current Moody’s Seasoned AAA Corporate Bond Yield of 5.12x, I derive a base-case IV of $175.60. This suggests an 18% overvaluation at present.

I also modelled the impacts a recessionary scenario could have on Apple’s earnings, with the assumption that a hard-landing for global economies would result in more restricted bottom-line growth. In this scenario (as represented by a reduction in the r value to 0.07 (7%)), shares are only valued at $130.00 suggesting a 60% overvaluation at present time.

Considering these calculations, I believe the firm’s stock continues to trade at a significant premium relative to the underlying value of the company. While Apple has historically managed to trade at a small premium above their IV, the current share price still generates some uncertainty for investors.

In the short-term (1-12 months) the premium valuation can increase volatility with any negative catalysts or macroeconomic developments leading to significant downward pressure on shares.

Over a longer horizon (1-10 years), investors would, of course, be less impacted by short-term volatility, with the initial 18% premium payment having an ultimately negligible impact on overall gains.

Considering these factors, I remain confident in the long-term future of Apple, while simultaneously being carefully cautious about the current pricing of shares.

Apple Risk Profile

No material change has happened to Apple from a business risk perspective. The company continues to be faced with real market, competitive and governance threats.

Cyclicality of markets threatens Apple’s revenue and bottom-line growth as recessionary or generally weaker economic environment result in consumers being less willing and able to spend on discretionary and luxury goods.

While this threat is essentially present for every single business operating in consumer discretionary markets, Apple’s premium positioning for their products could result in income stressed consumers pivoting to cheaper alternatives in periods of economic challenges.

Competitive risks also threaten Apple’s business tangibly, with recent developments in China highlighting this issue perfectly. Changing consumer tastes and preferences in China have resulted in an increasing number of potential customers choosing to purchase products from Apple’s competitors such as Huawei and Xiaomi instead.

This has resulted in a degradation in Apple’s pricing power leading to price-cuts being utilized in the pursuit of regaining the patronage of these customers.

While the changing preference for ‘home-grown’ goods in China could arguably be attributed to propagandistic practices being pursued by the CCP, the impact on Apple remains the same.

Finally, the impact governance changes could have on Apple’s business model are a real threat for the firm. Governments that are increasingly skeptical of potentially monopolistic practices pursued by Apple could result in the firm being forced to open-up their walled garden ecosystem in a manner which ultimately hurts their earnings potential.

While I do not view this as a concern at present, the potential for a more socialist government to impose damaging demands on Apple is worth considering given the ever-turbulent political landscape.

Summary

It should come as no surprise that I certainly admire Apple as a business. Their superb products generate pricing power which allows the firm to generate real excess returns on their invested capital and produce superb bottom-line figures from their operations.

Astute management of supply chains and business processes has allowed the firm to be a lean and profitable enterprise, which combined with their exceptional asset allocation strategy creates a solid set of enterprise economics upon which the Apple empire sits.

Unfortunately, the same cannot be said about the current stock price.

Shares are trading at what, I believe, is a real overvaluation, which would only be amplified should the U.S. economy enter into a recessionary period. As a result, I continue to be unable to advocate building a position in the tech giant.

Given the magnitude of uncertainties present in the current markets, I would consider a trimming of portfolio exposure to the firm, much akin to what Warren Buffett’s Berkshire Hathaway (BRK.B)(BRK.A) has accomplished in the previous quarter, hence my Sell rating.