Apple Stock: A Balanced Risk-Reward Profile, Hold (NASDAQ:AAPL) – Technologist

Nikada

Investment Thesis

Apple Inc.’s (NASDAQ:AAPL) performance over the last five years has been exemplary with its shares soaring 334.57% beating the S&P 500 by a margin of about 253%. This solid performance has been as a result of its strong financial performance and growth. However, Apple’s shares have been experiencing pressure of late due to its slowing growth and rising competition.

Although the company has a bullish face in its innovation and diversification as well as its competitive advantage and customer loyalty, I find this company to have a balanced risk-reward trade-off warranting a hold rating. Further, technical analysis points out to a neutral outlook lending credence to my neutral risk-reward phenomenon.

The Technical Take

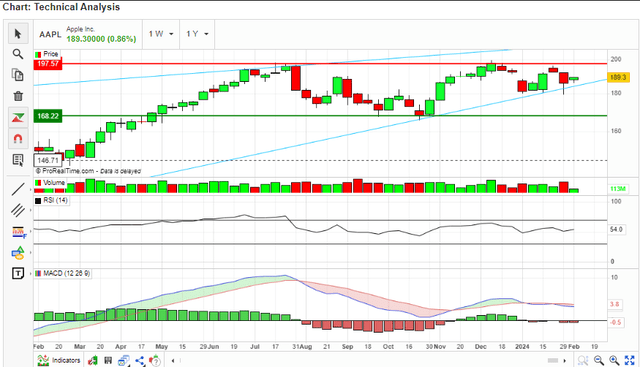

After five years of solid upward trajectory, this stock is currently forming a rising wedge pattern (as indicated by the two blue trend lines on the chart below) which is a sign of an imminent downside breakout. Notably, since June 2021, the price has shown signs of plateauing as indicated by its narrow price range indicated by the red rectangle below. This plateau phase shows that the bullish trajectory has lost steam and confirms the neutral outlook which could potentially usher in a bearish trend particularly when the price breaks below the lower trend line of the wedge pattern.

TradingView-Author

Let’s dive deeper and see what the indicators say. First off, the Oscillators are neutral with the RSI at the mid-range of 54 indicating that the stock is neither oversold nor overbought, most importantly; it is flattening confirming the neutral attribute. Looking at the MACD, it is slightly negative but the signal line is flattening indicating that the bullish momentum has weakened and this stock has entered a neutral phase.

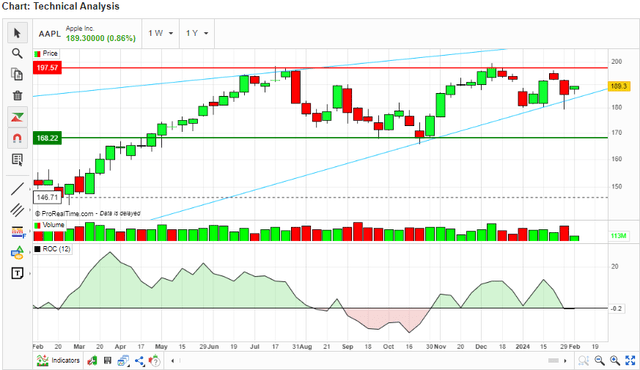

Market Screener-Author

To solidify my neutral stance on this stock is the price rate of change which has fallen to the zero mark perfectly confirming that the price has lacked momentum and that the stock is impartial.

Market Screener-Author

In conclusion, AAPL is in a neutral phase currently with some signs of a trend reversal. Investors should hold this stock as they monitor the clarity of the price action. A bearish trend would be confirmed by the price consistently breaking below the lower trend line of the wedge pattern as well as the lower range of its consolidation phase marked by the red rectangle in the first chart. Otherwise, if the price breaks above the upper trend lines it would mark a new upward rally. If it stays between the trend lines, then the neutral outlook is still on, and therefore a hold decision should prevail.

Apple Bull Case

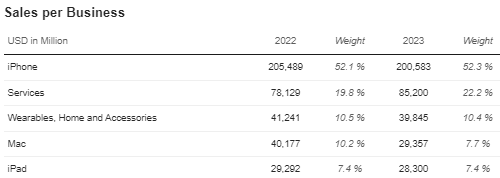

Apple has some attributes that make me optimistic about its prospects, some of which I will discuss here. To begin with is its innovation and product diversity. The company has a wide range of product portfolio which makes it appeal to a wide range of customer demand. Below are the company’s diverse offering and their respective revenue contributions.

Market Screener

With this background, I will discuss the iPhone because it is the major revenue contributor to demonstrate how Apple leverages its diverse portfolio to appeal to a wider target customer. iPhone is the most profitable product offered by this company, accounting for about 52.3% of its sales in 2023. This product targets the youth to middle aged customers who prefer quality and performance of tech products. In other words, the company employs the product concept as its marketing philosophy where by, customers go for quality products irrespective of pricing.

While this is a premium product and the company employs the product concept where consumers are relatively price insensitive, they have further differentiated the product into different models, sizes, and prices to appeal to a wide market of the premium class. For example, its iPhone 15 pro max being one of its most expensive models trading at about $1,199 and the iPhone SE being one of the most affordable models trading at about $429.

On the innovation front, Apple’s most recent release is its Vision Pro Headset with very unique and quality attributes warranting its premium pricing of $3,499. Following this innovation, analysts project that the product will outperform Meta and Sony in the virtual reality space. It is anticipated that by the fifth year of the launch, Apple will ship about 12.613 million headsets representing a 3,504% growth from 2024 and way above Meta’s Oculus Quest 2 headset sales of 10.4 million and Sony’s PlayStation VR sales of 6.6 million by the fifth year of their launches. In my opinion, this speaks volumes on the uniqueness and strong market potential of Apple’s innovative new launches which could improve its sales and margins significantly.

The other bullish aspect is its strong financial performance and growth potential. Over the last couple of years, AAPL has registered solid financial performance with a 3-year revenue CAGR growth rate of 11.72% and 3 3-year diluted EPS CAGR of 25.77%. Additionally, the company has been generating strong cash flows with its cash flows from operations growing from $80.7 billion in 2020 to $116.4 billion TTM.

Following its strong financial performance in the past, the company has been consistent in returning capital to shareholders through dividend payments and share buybacks. In 2023, it returned a total of $92.6 billion, $77.6 billion through share repurchase, and $15 billion through dividend payment.

At the moment the company has a dividend forward dividend yield of 0.51% and a payout ratio of 14.805 which in my view are relatively low and signifies that they have a massive room to grow in the future. This adds to my optimism about the stock in the future.

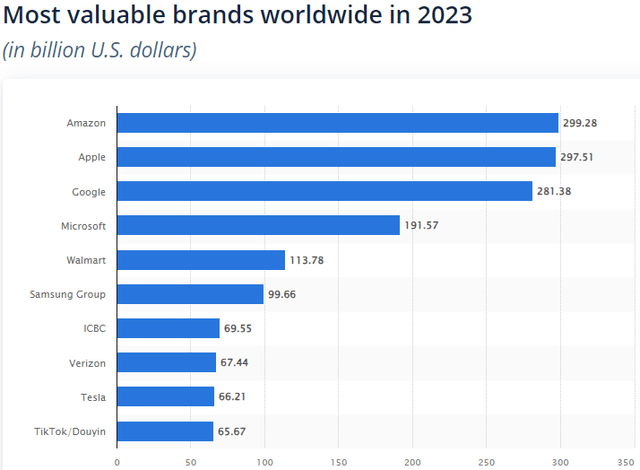

Lastly on my bullish side of AAPL is its competitive advantage and strong brand. Being the only company that controls the hardware and software of its product ensures that it achieves a seamless integrated user experience in its products, which is a leg up in terms of competition. In addition, the company has a very loyal customer base with a very high retention rate of 90% according to Gitnux. Further, it has a very strong brand recognition ranking as the second most valuable brand in the world with a brand value of $297.51 billion, slightly below Amazon’s value of $299.28 according to Statista.

Statista

The Bearish Case

Despite my optimistic case above, this company is also facing serious aspects that could cause a serious dent in its upside case. In the first place, it has a slowing growth and increasing competition. In the quarter ending December, it reported a sales decline of 13% in China one of its major markets. The sales in this region came in at $20.8 billion missing the estimated $23.5 billion. This performance has been driven by two major factors which are the cautious spending habits of the Chinese consumers following the tough macroeconomic climate and the increasing competition from other brands such as Huawei.

For instance, in the second half of the year, Huawei’s launch in the high end smartphone market with its Mate 60 series phones caused a major mayhem to Apple. It is important to note that it was powered by a domestically made chip which caused some sense of ownership to the Chinese consumers. This Model reached $30 million sales in China which was higher than Apple’s and outrighlty signals the fierce competition battle Huawei won. This slowing growth and increasing competition causes skepticism to me as far as its future revenue growth is concerned.

The other aspect likely to add to the downward pressure is its high valuation. Based on relative valuation metrics, AAPL appears to be overvalued. The stock’s trailing PE ratio is 29.24 which is higher than the industry median of 28.18. Most important is the PEG ratio which puts growth into consideration. Its trailing PEG ratio stands at 3.15 compared to the sector median of 1.07, a whopping 195.09% premium pricing. Further, the forward PEG ratio of 3.04 is 46.24% above the sector median of 2.08. This premium pricing signifies that the company’s shares are overvalued in relation to its earnings and future growth. For this reason, the company is susceptible to market corrections and sell-offs which may fuel the downtrend.

Lastly in this section are the company’s legal disputes which could hurt its reputation and affect its financials. For example, according to Bloomberg, the US Department of Justice is preparing an antitrust suit against Apple for alleged anticompetitive behavior against Spotify and Epic Games. This is a major risk because if the company is found guilty, it faces a fine of about $100 million alongside other possible sanctions. Such legal suits in my opinion may cause a serious dent in the company’s reputation as well as its relationship with developers.

One More Thing: Q1 2024 Performance

In its Q1 2024 report dated 1st Feb 2024, the company reported a revenue of $119.58 billion in its Q1 2024 earnings report, beating estimates by $1.31 billion and representing a YoY growth of about 2%. It reported a new record quarterly EPS of 2.18 representing a YoY growth rate of 16%. Further, its gross margin came in at 45.9% and net income came in at $33.92 billion a 13% growth YoY. This strong profitability in my view underscores the benefits of the company’s premium pricing as well as its cost control as a percentage of revenue.

However, despite the impressive part of the quarterly report, some negative aspects dent the positives. For instance, as earlier indicated its China’s sales declined by double digits which is alarming because this is one of its largest markets and the competition is growing significantly. In addition, its wearable segment sales declined by about 11% due to weak demand which further causes concerns about the company’s near-term outlook.

Given this background, Apple’s MRQ performance is mixed pointing out at a neutral outlook according to me. However, my long-term view of the stock is optimistic because I see strong growth levers. For instance, it has a very solid user base of more than 1.2 billion users which adds to its strong brand as discussed earlier. Further, its new product launches such as the Vision Pro Headset will boost its top and bottom lines given its anticipated sales trajectory. Lastly on the long-term growth drivers is its developments in generative AI which I expect to fuel growth given this is one of the most recent innovations in the tech industry. However, despite my bright outlook in the long term, my near-term take is neutral and thus a hold rating is justifiable here.

Investment Take Away

After a stellar performance in the last couple of years, Apple stock appears to have entered a neutral zone. The technical analysis has elaborated this clearly and the company’s bullish and bearish cases point out to a balanced risk-reward profile. For these reasons, I recommend patience before investing here.