Apple Stock: Antitrust Case Could Prove Positive For Investors (NASDAQ:AAPL) – Technologist

ozgurdonmaz

The Apple Investment Thesis

With the antitrust case that became public a few days ago, what I suspected in my last article in December has come true, when I said that Apple Inc. (NASDAQ:AAPL) could face the same fate as Standard Oil. Many commentators at the time said this was impossible, because they did not believe that some of Apple’s businesses could have monopolistic tendencies.

But just as I did then, I take the contrarian view today that this antitrust case could be positive for investors because it could lead to attractive purchase prices in the future. Sentiment toward Apple is relatively negative at the moment, but it is still one of the highest-quality companies in the world with very good prospects for the future.

In the following sections, I will explain why I believe Apple is well positioned for the future, why it remains one of the world’s strongest companies, and why I think lower prices could be very attractive for long-term investors.

Why Do I Think Apple Is Well Positioned For The Future?

A common criticism of Apple today is that the company is not growing at the rate its current valuation suggests, and therefore the stock is overvalued. But I think those people are missing the incredible opportunities that Apple has to reignite growth.

The incredible number of satisfied users in the Apple ecosystem and Apple’s allocation of capital are incredible competitive advantages. The value-creating share repurchases of the past few years have resulted in existing investors owning an increasing share of the company without having to purchase new shares. Because historically, the number of shares outstanding has declined by ~ 3.5% per year. And I am very confident that these buybacks will continue in the future.

But the reason I think Apple is going to get back on the growth track is because of the incredible opportunities in health monitoring and health tracking with the Apple Watch and the iPhone. Harvard Health, for example, believes that remote patient monitoring will play a very important role in the future and that we will be able to check the status of our organs in real time. In the U.S. alone, it is estimated that more than 70 million patients will be using telemonitoring by 2025, which shows the huge potential if you include all other countries.

Today, it is already possible to connect wireless blood pressure monitors to the Apple Watch or detect atrial fibrillation based on irregular heartbeats. And this is just the beginning; in the future, we may be able to use samples of sweat, blood, saliva, or tears to better understand diseases and improve early detection and prevention.

Breathing patterns, blood glucose readings, and even hydration levels will soon be tracked in real time and automatically sent to the doctor, if desired. This could effectively treat or detect conditions such as diabetes, sleep apnea and dehydration. And all of this could lead to new recurring revenue for Apple if they offer paid services that use this data. Combined with machine learning for early pattern recognition, this could be a significant value proposition for users, further engaging them in the Apple ecosystem.

In addition, it is possible to monitor vital signs via video, which is possible with the camera in the iPhone. A research article here has shown that it can be used to analyze skin discoloration, chest movements or even tongue discoloration and draw important conclusions. And since Apple is known for its high standards, I think the Apple Watch’s sensors and the iPhone’s camera would provide very accurate results. Apple tends to release features only after they have been thoroughly tested and proven to work as promised.

What Are The Obstacles And Difficulties Apple Might Encounter?

However, this brings us to the point that the algorithms, sensors, and data collected must be accurate. Without reliable data, it will not work. And this is where the smartwatch rankings speak a clear language, as the Apple Watch continues to do very well in the rankings. So with its built-in sensors and technology, Apple is currently one of the market leaders.

And the things that set Apple apart in the smartphone market are the same things that set them apart in the smartwatch market – the intuitive interface and the great display. And one of the biggest advantages is still the Apple ecosystem and the acceptance of users to move within it, because they appreciate the secure platform and they know that bugs will be fixed quickly and that Apple makes data security a top priority. And data security will be one of the most important issues when it comes to sensitive health data.

Another important issue will be data collection and interpretation. I think that Apple is working hard on an internal solution here, but they will probably also consider other companies if they have found efficient solutions. Apple’s pockets are deep enough to acquire interesting companies, but a potential collaboration with Google’s Gemini could also bear fruit in the form of outstanding solutions.

Are There Other Growth Opportunities For Apple?

After the Titan project – an Apple car – was cancelled for the time being, the news broke yesterday that Apple is working on personal robots. It’s certainly a very interesting market, but it’s still in its infancy, and companies like Tesla, Inc. (TSLA), Amazon.com, Inc. (AMZN), and NVIDIA Corporation (NVDA) are also trying to break into it. But the potential must be there if these giants are thinking about this future market.

Apple is also continuing to develop its virtual reality solution and has unveiled its latest flagship model, the Vision Pro. The company is still pursuing its familiar high-price strategy, attempting to differentiate itself through quality and design from its competitors, some of whom offer cheaper solutions. But Apple is trying to stay true to its brand strategy, which has been one of its success factors over the last few years. I also believe that blended reality will be a large part of our daily lives in 5 years, and therefore I think it is right to focus on this area.

Could The Lawsuit Have A Big Impact?

Depending on the outcome of the litigation, there are many possible scenarios that could negatively impact Apple’s revenue. App Store sales could be negatively impacted, and Apple Watch sales could decline. On the other hand, Apple Watch sales could also increase if everyone can use it with other smartphones.

In addition, this litigation is likely to extend over a very long period of time, so the actual impact will not be felt for some time. In the worst case, the Apple ecosystem, one of Apple’s greatest competitive advantages, would be permanently disrupted. But in the end, Apple could just as easily be fined, which would be unpleasant but not as devastating.

Apple’s Valuation

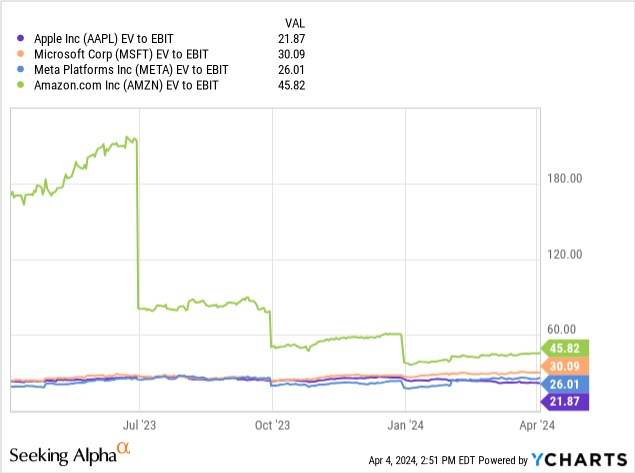

Given Apple’s litigation and slowing growth, as well as Huawei’s success in the Chinese mobile market, the EV/EBIT multiple is already below its peers, but not yet at a level where it could be considered undervalued. When Berkshire Hathaway Inc. (BRK.A) bought its Apple position, the multiple was 13 to 14, which they considered an attractive entry price. So there is still room to go lower. However, if the lawsuit results in the stock returning to this range, I believe this could be a very attractive opportunity for long-term investors.

Conclusion

Apple continues to play in a league of its own in terms of capital allocation, and its brand and ecosystem remain intact. And of course, sales growth is currently lower than many shareholders would like, but this is likely to be temporary given the growth opportunities.

If the lawsuit continues to depress the stock price, it could result in the stock being undervalued in the future. Because the sentiment towards Apple stock is relatively negative right now, and these are often the situations that are profitable in the long run when you can get such great companies at fair prices.

And since investing is all about where the company is going to be in 3 to 5 years, and I think Apple has a bright future, I think falling prices or even the current price could be interesting in the long run.

If you had invested in Microsoft Corporation (MSFT) when they had their case before the DOJ, you would have had a very attractive investment to this day. And even if it should come to pass that Apple must divest itself of parts of the company, great opportunities could also arise.

/cloudfront-eu-central-1.images.arcpublishing.com/prisa/FQTQDW6N5REWXIOMDD7KHS5X7U.jpg)