Apple Stock: Not So ‘Magnificent’ So Far In 2024 (AAPL) – Technologist

ozgurdonmaz

Depending on the reality one must face, one may prefer to opt for illusion.”― Judith Guest.

Apple Inc. (NASDAQ:AAPL) is a core part of the “Magnificent Seven” that drove approximately two-thirds of the just over 24% gains from the S&P 500 (SP500) in 2023. The stock rose just over 40% on the year despite seeing flat earnings growth and a three percent decline in revenues in FY2023. The stock began 2023 selling at roughly 20 times earnings and ended the year being valued at nearly 30 times profits per share.

Seeking Alpha

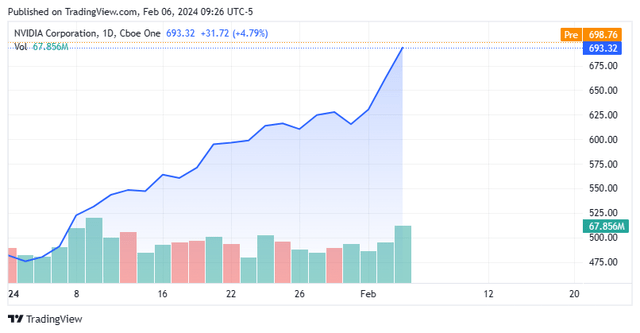

2024 has been a slightly different story. While other members of the “Seven,” like Nvidia Corporation (NVDA), Meta Platforms (META), and Microsoft (MSFT), continue to move sharply ahead and lead the rally in here in the early stages of 2024; Apple, however, has been a laggard. The stock is down some two percent on the year.

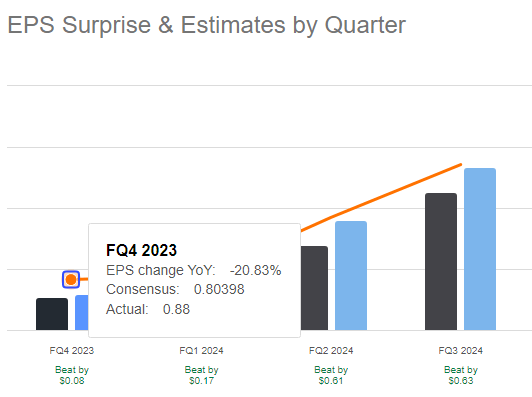

NVIDIA Quarterly Earnings History (Seeking Alpha)

There are numerous reasons for this divergence. The names listed above are all riding the “AI Wave” which Apple is not a major participant within. In addition, these companies have posted more than solid Q4 numbers, with Nvidia’s results blowing away expectations and leading to an approximate 40% rise in the stock so far this year.

On February 1st, Apple posted its Q1 2024 quarter results. The company delivered earnings of $2.18 per share on $119.6 billion. This slightly beat both top and bottom-line expectations, and also was the first time Apple has posted year-over-year revenue growth in five quarters. Earnings per share rose just two percent from the same period a year ago.

Seeking Alpha

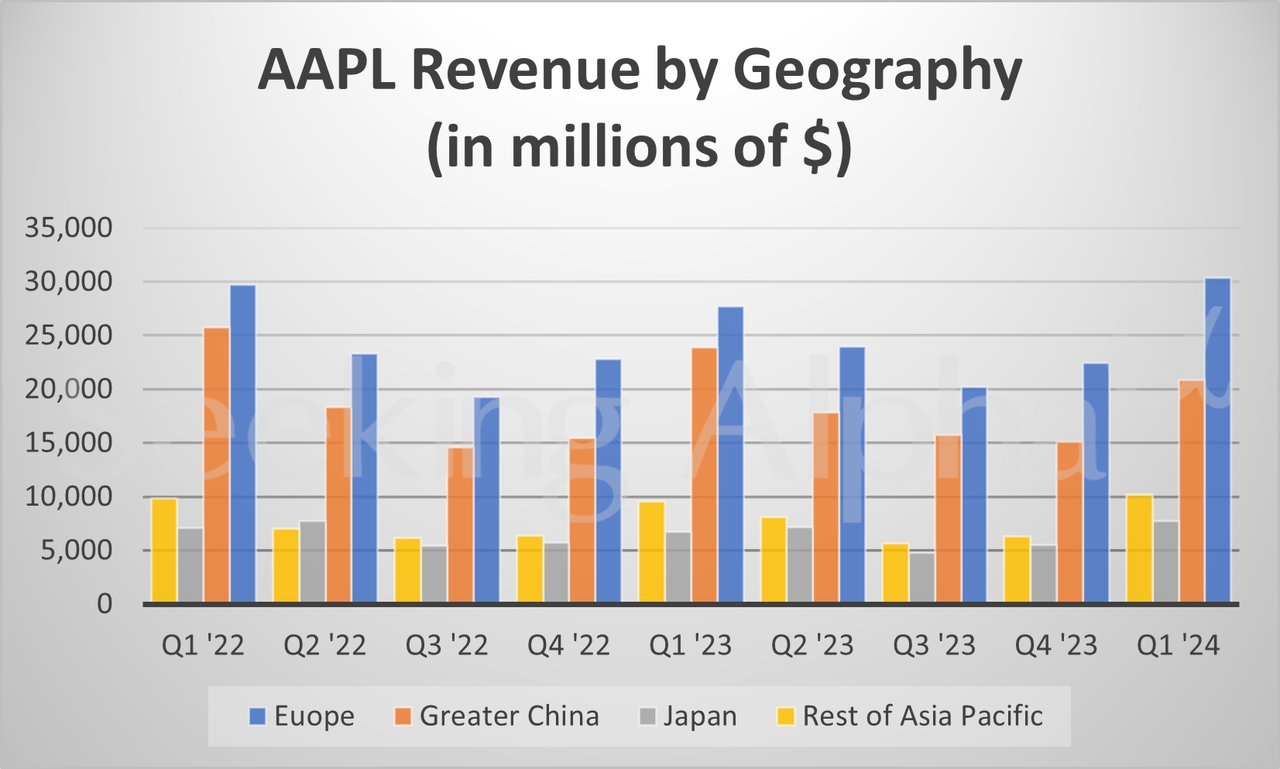

Investor reaction to quarterly numbers was tepid, however. Of particular concern were results from China, where sales came in at $20.8 billion, significantly below the consensus of $23.5 billion as the company faces increasing competition from the likes of Huawei and Xiaomi.

Seeking Alpha

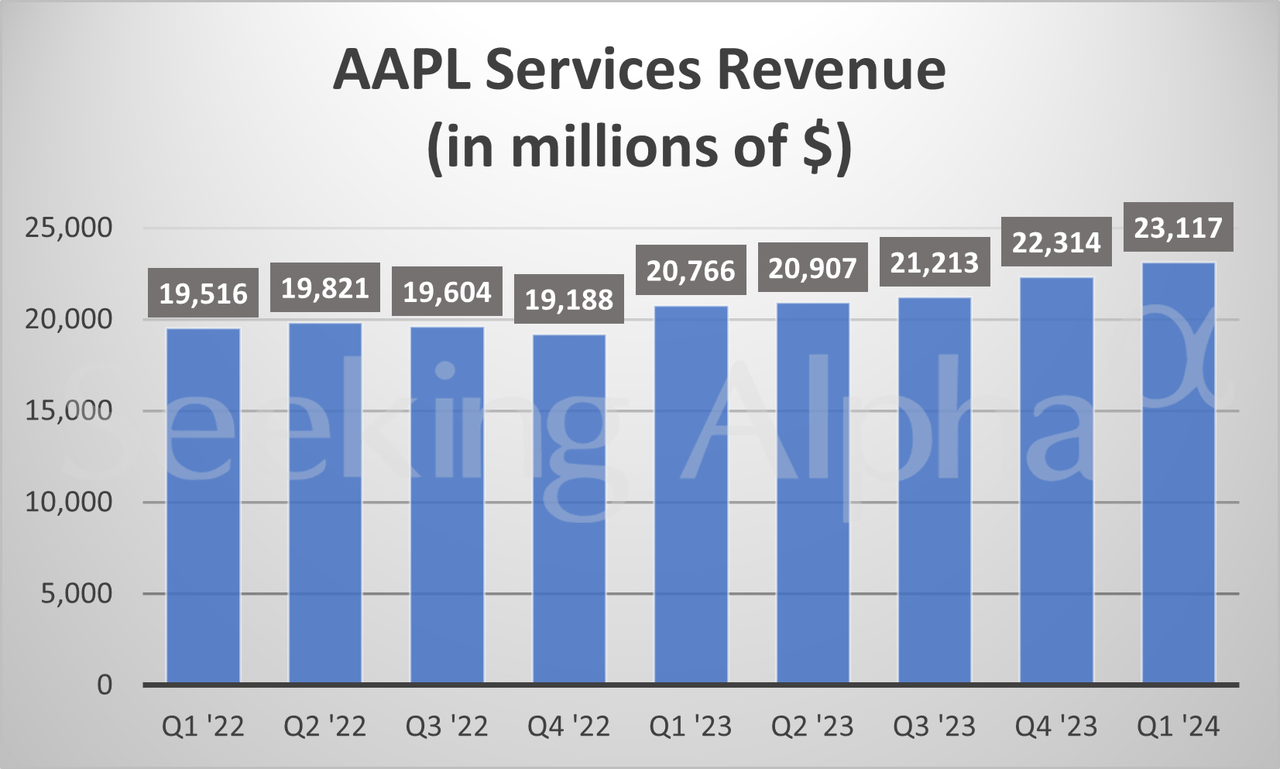

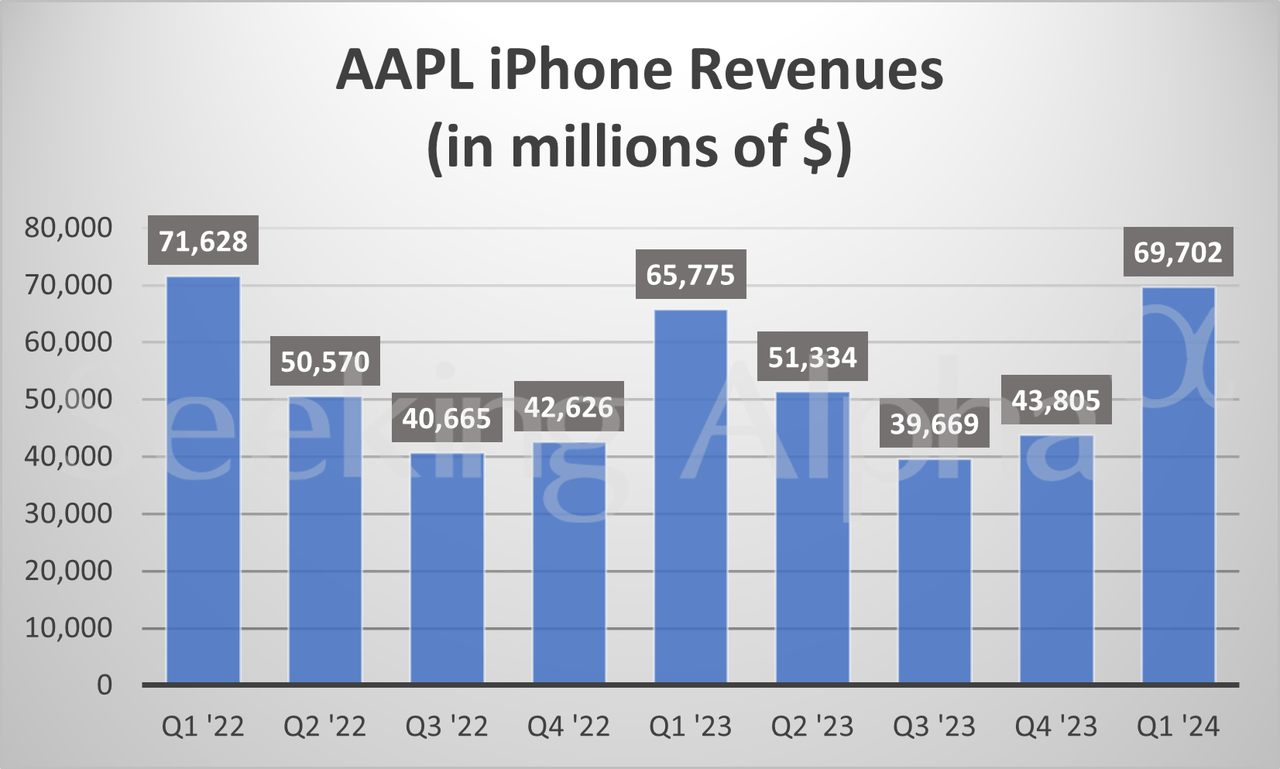

While Services revenue came in at a record $23.1 billion for the quarter, it was $300 million below expectations. Apple’s franchise iPhone product line did deliver sales of $69.7 billion, which was above estimates and up $4 billion from the same period a year ago.

Seeking Alpha

During the quarter, the company posted $40 billion of operating cash flow, of which it returned $27 billion of that to its shareholders via stock buybacks and dividend payouts. Both numbers sound impressive, except when taking into context that the company has a nearly $2.9 trillion market capitalization. Apple owned the largest market capitalization of any equity in the market for years but was surpassed earlier this year by Microsoft. Using the fourth quarter run rate, AAPL currently has an operating cash flow yield of approximately 5.5%, about the same as the yield on a “risk-free” short term Treasury bill.

Analyst opinion has been very mixed since Q1 results hit the wires, an unusual situation for Apple. I count a dozen analyst firms including Wedbush, Jefferies and Goldman Sachs reissuing/assigning Buy or Outperform ratings on the stock since fourth quarter results were posted. Price targets proffered range from $194 to $250 a share, with most price targets in the low $200s. Eight analyst firms including UBS, Piper Sandler and Evercore ISI have reiterated/initiated Hold or Sell ratings on the equity. Their price targets range from $158 to $200 a share.

Long-time tech analyst Dan Ives at Wedbush had this to say about the quarter:

“China remains a bumpy ride and represents roughly 20% of iPhones (17% this quarter) and clearly [it’s] no secret Apple is struggling to battle Huawei and geopolitical headwinds near-term”

Even as he retains his bullish opinion on the stock.

Probably the biggest positive buzz, Apple has experienced this year concerns its rollout of its Apple Vision Pro that retails for approximately $3,500. The product has been well-received in the market and garnered plenty of accolades as well. However, with recent estimates calling for 600,000 units to be sold in 2024 and another one million in 2025, this product success is not going to move the needle at a company as large as Apple.

The current analyst firm consensus has earnings growing by seven percent in FY2024 to $6.58 a share as sales rise two percent to $390 billion. Hardly compelling projections, given Apple shares trade at over 28 times forward earnings and more than seven times revenues. The stock pays a small dividend of a half of a percent.

Therefore, I expect Apple Inc. shares to be rangebound in 2024 at best while the stock consolidates its large gains from 2023. An ordinary year for the company and its shareholders, after the stock was “Magnificent” last year.

You can be extraordinary in anything but not in everything.”― Amit Kalantri.