Apple: Strong Earnings Expected, Secular Challenges Persist (NASDAQ:AAPL) – Technologist

SL/iStock Editorial via Getty Images

My thesis

Apple Inc. (NASDAQ:AAPL) is releasing its fiscal Q3 earnings this week and there are several solid signs that the company will deliver a positive surprise once again as the global smartphone and PC markets are recovering and gaining momentum. Moreover, the Services pricing power will also likely support the EPS growth. That is the main reason why I still think that AAPL is a Hold.

However, I am considering trimming or even closing my AAPL position in the upcoming quarters because the company’s current $3.3 trillion market cap is a way too generous valuation for a company that has a massive iPhone concentration risk. None of the company’s new products launched after its flagman is close in terms of revenue. Moreover, I believe that products like the iPad and Mac overlap with each other, especially after the recent release of the brand-new iPad Pro with its revolutionary M4 chip.

AAPL stock analysis

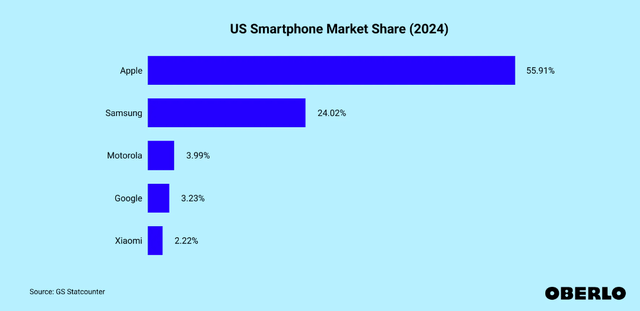

According to Oberlo, Apple dominates the U.S. smartphone market with a 56% market share. Apple is currently not leading in the global smartphone market, but its share in Q1 2024 was still notable at 17.3%. The company’s flagship iPhone has been dominating the industry for years, and its new releases are still among the most desired Christmas gifts.

Oberlo

Apple’s brand power is unparalleled, in my opinion. The iPhone 15 does not appear to be completely unique compared to its previous generation model, the iPhone 14. Nevertheless, people are still ready to pay around $1,000 to get the new model, and it is common that there are massive queues to get one in different Apple Stores across the world. Each presentation of a new iPhone is a big event which is watched live by millions of users worldwide. I consider such a long-lasting iPhone mania to be the company’s apparent fundamental strength.

Apart from a massive genuine brand loyalty, Apple has created an ecosystem of services and subscriptions, which also increases switching costs for customers. Moreover, for a person who pairs the iPhone with the company’s other devices like the iPad, or the Apple Watch, it will be difficult to buy an Android-based smartphone instead. The integration with services like iCloud creates even a stronger bond, based on my personal experience. An ecosystem blended with a massive brand loyalty helps the company to drive further growth.

For example, iPhone sales were about flat recently, with subtle or no growth. This is explained not only by the record inflation and interest rates recently, but also by the intensifying competition. The company is struggling in China, one of the world’s most crucial markets for any company, and I consider it as a fundamental risk. However, the company drove consolidated profits growth with its Services. There were massive subscription price increases for services like the iCloud and Apple TV. I am far from being a person who is ready to stay in queues to be one of the first who gets the new model. However, I do not imagine how I can switch to Samsung or Huawei, even if the company makes the iCloud subscription five times pricier.

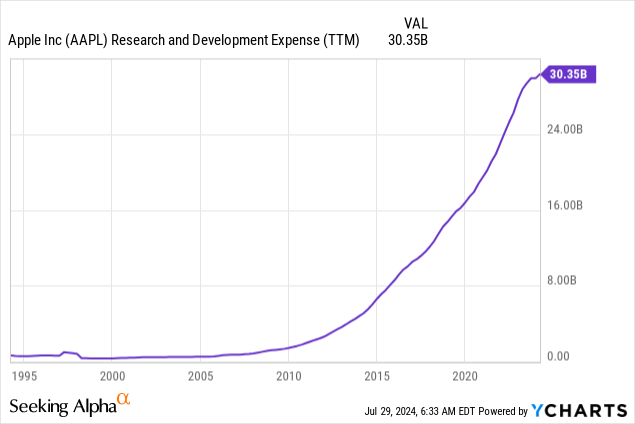

The iPhone’s market position is intact, and its stellar ecosystem will help in boosting profits, even if the competition in the smartphone industry continues intensifying. Moreover, the company’s commitment to develop its products is undisputable, which I see from Apple’s exponentially growing R&D spending.

On the other hand, for a $3.3 trillion company, relying on a sole profit’s growth driver might be insufficient from the longer-term perspective. Every product has its life cycle, and the iPhone that was first launched in 2007 looks like a “veteran” in our fast-paced world. It is difficult to predict ten years from now, but the scenario where the iPhone is disrupted by a brand-new communication means does not look unrealistic to me.

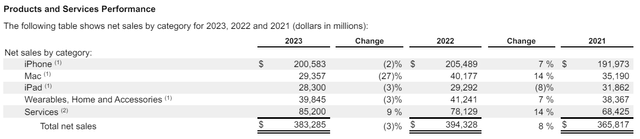

Apple has launched loads of different products after the first iPhone, but none of these new products became even close to the flagman in terms of revenue figures. The company has recently released its brand-new iPad Pro with a revolutionary AI Chip, and this is great. On the other hand, this tablet with a massive computing power creates competition with the company’s Mac. I do not see the need for a person to have both products if they deliver approximately the same performance and solve problems which overlap.

The company’s latest big new product was its Vision Pro VR headset released a few months ago, which failed to sell out on its launch date, which is rare for Apple’s products. The headset starts at $3,499, around 3.5 times pricier than the average iPhone. According to the source, the company expects to sell around 450,000 units in 2024. This means a total of around $1.6 billion revenue from the product in 2024, which is insignificant relative to the company’s scale. To match at least the iPad’s revenue, Apple needs to sell around 8.1 million Vision Pro units per year. Therefore, the uncertainty around this product is still very high, and I would not risk mentioning it as a potential positive long-term catalyst for the company.

10-K of AAPL

The most significant upcoming catalyst that I see for Apple is its nearest earnings release planned for August 1, post-market. The last time Apple missed consensus EPS estimates was the December 2022 quarter. Despite fiscal Q3 revenue growth is expected to be modest again at 2.8% YoY, Wall Street analysts expect the EPS to grow by 5.9%. I think that growth in Services revenue will once again will be the major EPS growth driver, as in several previous quarters.

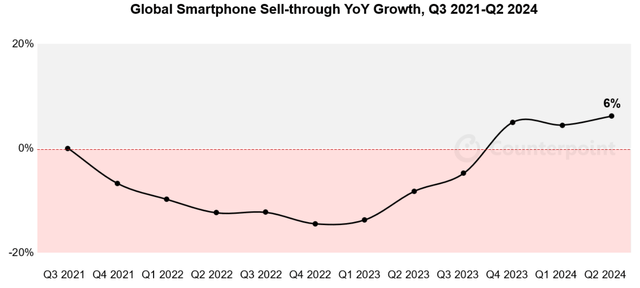

There are a few important signs that the company is likely to deliver strong results against consensus forecasts. Since more than half of Apple’s sales are generated by the iPhone, it is critical to note that the global smartphone market grew by 6% YoY in Q2 2024, which is the highest YoY quarterly growth over the last three years. The global PC market also demonstrated growth in Q2 2024, which is another positive sign before the company’s earnings.

counterpointresearch.com

To conclude, I am optimistic about the company’s upcoming earnings release, as there are numerous bullish signs. Moreover, the stock rallied massively after the previous earnings release, meaning that the company can still surprise investors.

On the other hand, my opinion from the secular perspective is mixed. The iPhone’s current market positioning is intact, and Apple’s potential to drive further EPS growth with only exercising pricing power in Services looks real. However, Apple appears to be relying on its flagman too much for a $3.3 trillion dollar company. It appears that the company does not have other notable growth profitability drivers apart from Services. None of its products are close to the iPhone’s scale, and some of them appear to be competing.

Intrinsic value calculation

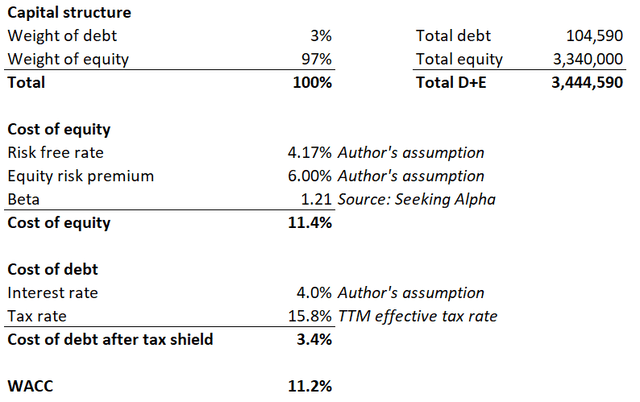

The discount rate is a vital assumption for the discounted cash flow (DCF) model. Therefore, I start with calculating the weighted average cost of capital (WACC) using the capital-asset pricing model (CAPM). Below working outlines my WACC calculations. AAPL’s WACC is 11.2%.

DT Invest

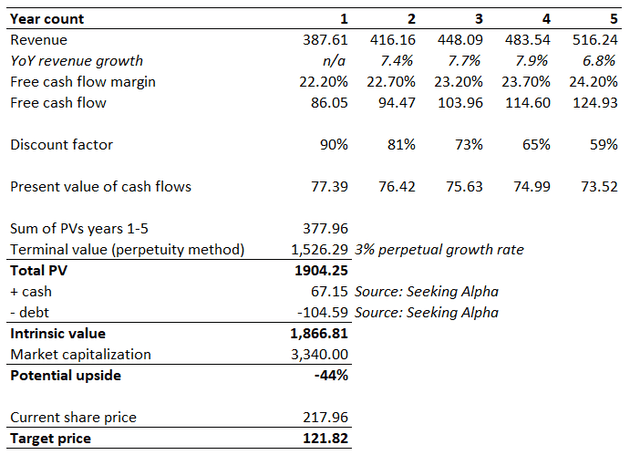

Consensus estimates appear conservative, as they observe a mid-single digit revenue CAGR for the next five years. A 22.2% TTM levered FCF margin is projected for year 1. Since Apple has been historically strong in expanding its profitability ratios, I project a 50 basis points yearly expansion in FCF margin. Since Apple confronts the law of large numbers, it is difficult for me to incorporate perpetual growth rate higher than inflation levels. Therefore, the perpetual growth rate will be fair at 3%.

DT Invest

With conservative revenue growth assumptions, the company’s intrinsic value is way below its current market capitalization. There is around 44% downside potential, according to the above working.

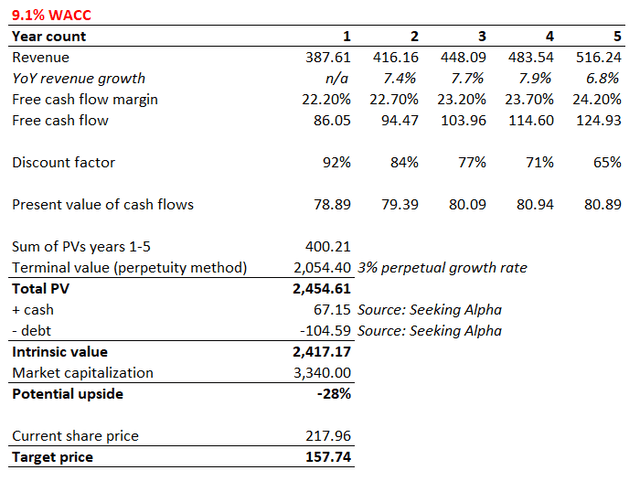

An 11.2% WACC might be too aggressive for a company like AAPL, especially in light of expected interest rates cuts by the Fed in late 2024 and through 2025. Decreasing the risk-free rate to 2% in my CAPM model softens WACC to 9.1%. However, even with a notably lower discount rate, the intrinsic value is still 28% below the current market cap.

DT Invest

What can go wrong with my thesis?

My thesis is mixed because I think that recommending selling the stock will be unfair while I am the owner of the stock and multiple Apple products. On the other hand, it appears that unrealistic optimism is incorporated into the share price. Therefore, I do not recommend buying the stock at the current price and if the stock rallies further it will mean that my thesis went wrong.

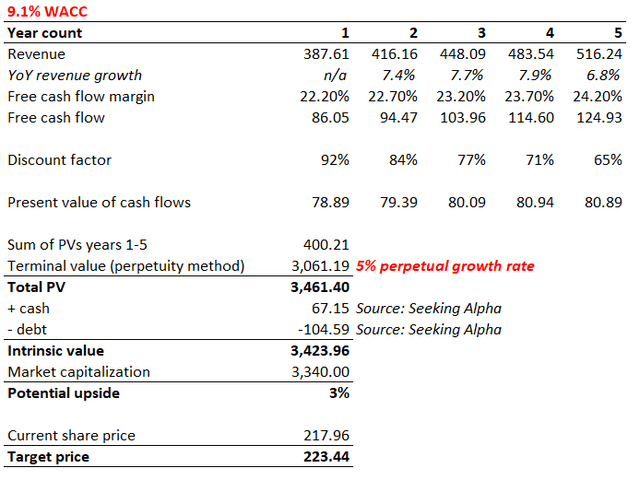

The current market capitalization is justified if a 5% perpetual growth rate is incorporated. While such a perpetual growth rate does not look unrealistic in general, I think that the probability of Apple delivering such a growth rate is quite low. The company is expected to surpass a half-a-trillion revenue milestone by the end of 2020s. Delivering growth will be very hard against vast amounts, especially considering some fundamental challenges that I have described earlier in my analysis.

DT Invest

Summary

I continue to Hold my Apple Inc. position because I expect the company to deliver a strong earnings report this week, which will likely support the share price even despite the current massive overvaluation. However, due to secular risks that I have described, I think that I will start considering trimming my position later this year.