United States V. Apple: The Winner Could Be You (Rating Upgrade) (NASDAQ:AAPL) – Technologist

kieferpix

Thesis Summary

Apple Inc. (NASDAQ:AAPL) has recently been sued by the DOJ, which has accused the company of holding a “broad, sustained, and illegal” monopoly over smartphones. There has even been speculation that the Apple company could be forced to break up.

The stock dropped following the news and is down over 15% since its all-time high, which I believe could make for a compelling entry point.

In my last article on Apple, I called the company an overvalued value stock, based on its rich valuation and bleak growth prospects.

However, things have changed, with Apple’s stock now offering a slightly more attractive valuation, and growth prospects much improved.

The company has struck a major deal with Alphabet Inc. (GOOG), (GOOGL) and now possibly Baidu, Inc. (BIDU), too, in order to further leverage AI technology.

The market is not pricing in Apple’s AI potential, and though the stock is still expensive, I am moving this to a buy rating, based on the improved outlook and also my technical analysis of the stock.

What does the DoJ want?

The DOJ has filed a lawsuit against Apple, stating that the company has abused its position in order to limit competition when it comes to both its hardware and software products.

The lawsuit specifically questions the functionality of iMessage and the interconnectivity of Apple products like the iPhone and Apple Watch. The complaint states that the case aims to “free smartphone markets” from Apple’s anti-competitive behavior, contending that the company has impeded innovation to maintain its market dominance.

Source: India Today.

It’s a tale as old as time.

The DoJ is claiming that Apple is not allowing fair competition in its ecosystem and products. Apple – rightfully so, in my opinion – would likely argue that it is within its rights to control what happens within its services and products.

Apple does not command control of the entire smartphone market, but it does have a “monopoly” on the iPhone, which represents around 50% of the market. But that’s an Apple product, and so is its operating system.

Some would point out that Android does not limit competition in the same way, but as far as I see it that is simply a business choice. Keeping a network “closed” or making it “open-sourced” comes with both its advantages and disadvantages.

This is a point I discussed in my last Advanced Micro Devices, Inc. (AMD) article, which offers an open-source alternative to the NVIDIA Corporation (NVDA) CUDA platform.

What are the possible outcomes?

The important thing here for investors is what could come of this decision by the DOJ.

These range from a fine to a potential breakup of the company.

While the DOJ’s charges are focused on iPhone, we do not see likely remediation as materially impacting Apple financially or undermining the iPhone franchise: worst case, Apple pays a fine, and loosens restrictions for competition across the iOS platform, which we believe will have limited impact on iPhone user retention or on Services revenues.

Source: Toni Sacconaghi, Bernstein.

A couple of important takeaways from this quote.

Firstly, this case will indeed take years to play out in the courts, and we won’t have a resolution for some time.

Now, while I agree that the most likely scenario would be a fine, I don’t agree that loosening restrictions won’t impact iPhone retention and revenues. If that were the case, then why would Apple be implementing these policies in the first place?

On the other extreme, this lawsuit could lead to some form of a breakup of the Apple company, though the DOJ has not specifically said this is its intention.

A precedent of this can be found in Bell Systems, which was broken up back in 1982, though this was done by then-AT&T Inc.’s (T) own accord once they believed they would lose the antitrust lawsuit.

This does seem like an unlikely outcome at this time, though.

Apple’s Untapped AI Potential

With all this said, the DOJ lawsuit has created another sell-off in the stock, which is down 15% since its highs, and this comes at a time when Apple has also shown a lot of potential for increased growth.

Most notably, Apple and Google are discussing bringing Google’s generative AI search engine, Gemini, to the iPhone.

This will ensure that Apple delivers the best AI capabilities in its upcoming products, including the iPhone 16.

In addition, it has been reported that Apple is in talks with Baidu to do the same in China. This will be an incredibly important step for Apple to secure its position in the Chinese market, which likely won’t allow foreign companies to provide AI models within the country.

And, of course, Apple is set to be a major beneficiary of the transition to AI-PCs.

In 2024, about 18% of total personal computer shipments globally will be AI-capable PCs,

Source: Seeking Alpha.

Apple is perceived by many as a company that makes phones, but in the last few years, it has become so much more.

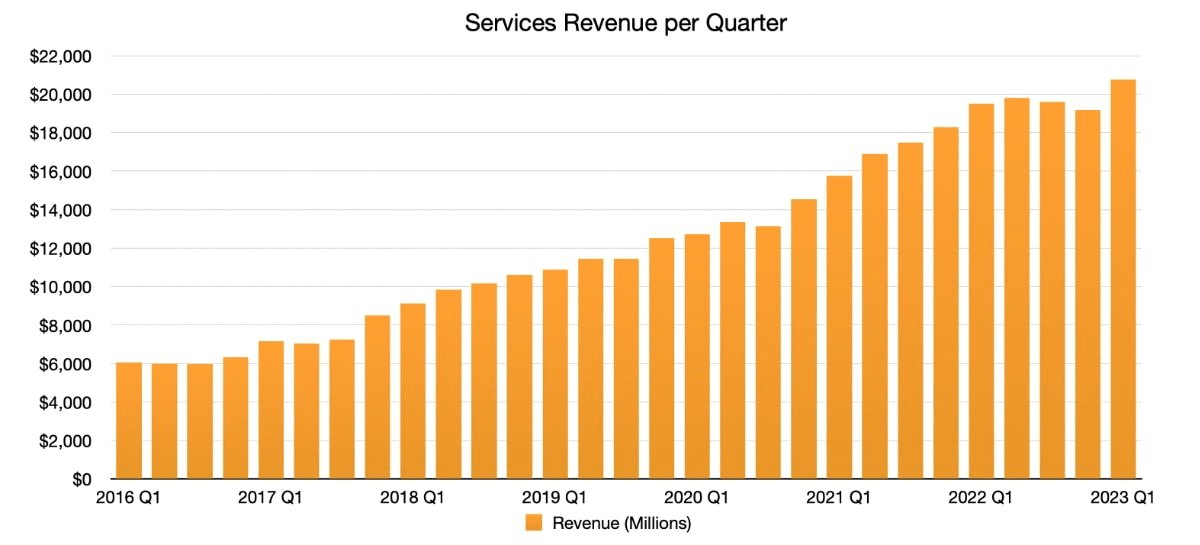

Service Revenues (Apple Insider)

Specifically, its service revenues, which carry a much higher margin, have been growing at a fast pace.

AI technology will serve to fuel the value offered by Apple’s services, and I have no doubt that the company stands to benefit meaningfully from this revolution.

Valuation

Granted, Apple stock isn’t cheap, even compared to its mega-cap tech friends:

|

AAPL |

GOOGL |

MSFT |

AMZN |

META |

|

|

P/E GAAP (FWD) |

26,15 |

21,68 |

36,84 |

43,00 |

25,45 |

|

Price/Cash Flow (TTM) |

22,73 |

18,04 |

31,08 |

21,78 |

18,20 |

|

PEG Non-GAAP (FWD) |

2,78 |

1,32 |

1,05 |

2,44 |

1,85 |

Data source: Seeking Alpha.

With that said, Apple’s Price/Cash flow remains reasonably attractive at a little under 23x. When we look at forward earnings growth, Apple is the most expensive, as the company is not expected to grow its earnings as much as its peers.

However, I believe this overlooks some of the tailwinds that Apple will benefit from in the coming years.

Namely, I believe Apple’s earnings could surprise to the upside as the company makes strategic partnerships, invests in AI, and continues to innovate.

Apple is not cheap, but it may never be. The company has always commanded a premium due to its incredible moat, brand, and strong balance sheet.

However, the company is cheaper than it was, and it is also approaching an important technical level.

Technical Analysis

Here’s my technical outlook for the stock.

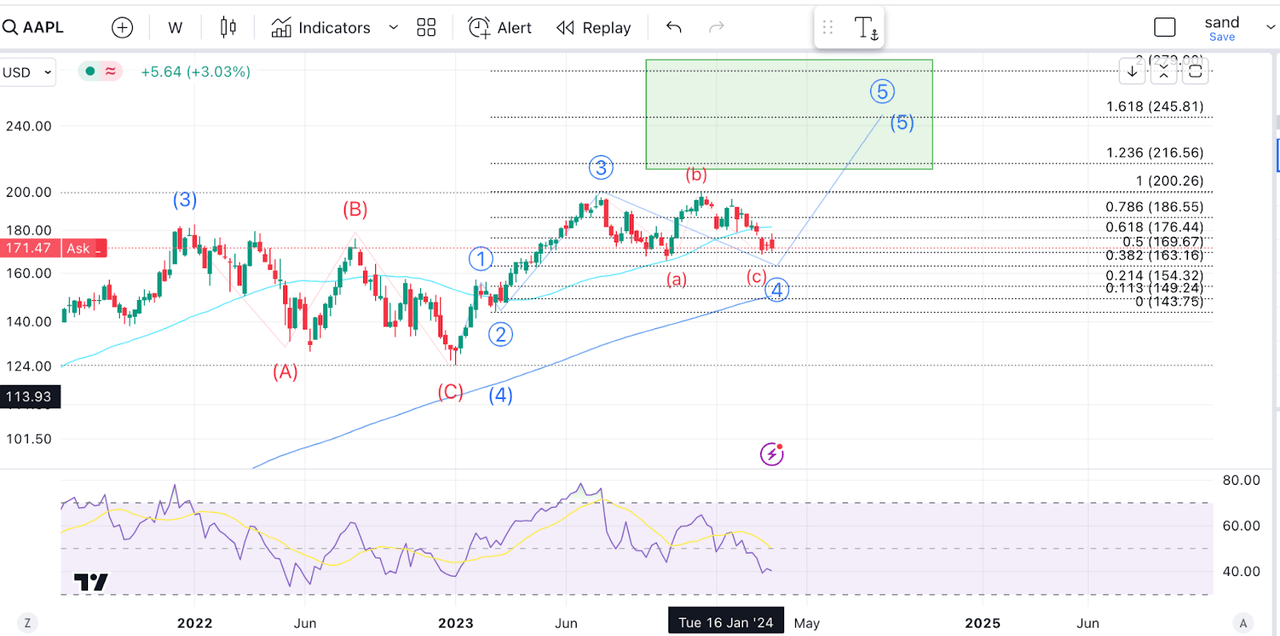

Apple TA (Author’s work)

As we can see, Apple’s stock looks like it is trying to complete an ABC retracement from its recent top, not unlike the structure we saw develop in 2022 after the stock topped in wave (3).

Now, the key thing here is that we are getting very close to the 61.8% retracement level at $163, which would offer us a very good entry. Below that, the 200-week MA offers support at $150, but I’d be surprised if we got there unless we enter a bear market.

Risks

Of course, the DOJ lawsuit is a major risk to the Apple thesis. The DOJ has already sued the company three times, but it is still unknown how this will pan out. Anything more than a fine would come as a surprise to investors.

On top of that, I also feel that China is a major risk for Apple, too. The company has already been mitigating its exposure, at least in terms of production, but it could stand to lose substantial revenues from the iPhone in the future, not unlike what has happened to Tesla, Inc. (TSLA) in recent months with their EVs.

Takeaway

Overall, I think Apple is a great company, if a little “overvalued,” but pretty much in line with its peers. While the risks of the DOJ lawsuit have been priced in, investors are overlooking Apple’s ability to profit from the coming AI revolution.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.